Note: Please note that the EGG proposal has been updated in the part related to the Discretionary Costs on 10 Dec 2025.

The comments below reflect the most recent changes.

Comments to EGG 2026 Proposal

To support the EGG 2026 proposal and assist voters in making informed decisions, Lido Labs Foundation has prepared a set of financial analyses that includes:

- consolidated forecasted net impact for the DAO Treasury for 2026 ;

- a net impact on the DAO Treasury for 2025 (with December figures presented as projections);

- a comparison of the current EGG 2026 Request with last year’s EGG requests.

Key assumptions on projections are the same as in EGG request:

- ETH at $2,712 (2-year median price between Nov 2023 and Oct 2025),

- 2.93% staking APR,

- total ETH staked +15% to 41M ETH with Lido’s share rising to 27.3%, including 10.1M ETH staked via Lido Core and 1.05M ETH staked via stVaults.

- The current projection does not account for any potential impact from Liquid BuyBacks, because:

- The DAO has not yet made a decision regarding the buyback program

- currently proposed buyback parameters would not be triggered under the conservative ETH price assumptions used in the model.

TL;DR

- Operational impact on DAO Treasury is –$6.0M in 2026 under conservative ETH price assumption of $2,712, due to the investment in growth initiatives. Treasury stETH holdings decline to 30.7k stETH (–9%).

- Lido Core generates +$8.1M total surplus even under conservative ETH price assumption.

- Gross staking rewards decrease –8% YoY in USD but grow +2.5% in ETH, indicating that the decline is driven by the ETH price assumption rather than performance.

- Net revenue from staking fees grows +10% YoY in USD terms due to the GOOSE-3 Growth initiatives such as Core Upgrade and stVaults.

- Lido Earn and New Bets add $4.7M to 2026 DAO revenue, diversifying revenue streams.

- Operating Expenses decrease ~17% YoY, from $32.4M to $26.9M, following cost optimization and refocusing Core spending on protocol-critical functions.

Comparison of 2025 Actuals and the Proposed 2026 EGG Request

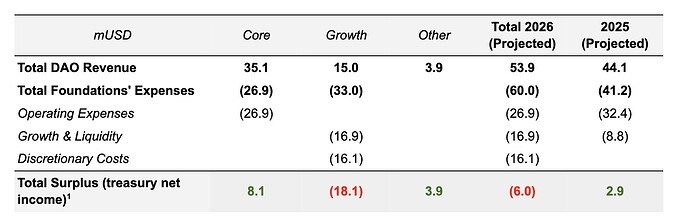

Below is a table comparing the projections for 2026 with the 2025 actuals (preliminary, as of December 8).

Note: The table below is divided into two categories: DAO Revenue and Foundations’ Expenses. The 2026 EGG Request provides funding for the Foundations’ Expenses. All revenue generated through the Foundations’ activities flows back to the Lido DAO and is reflected under DAO Revenue.

[1] Net revenue from staking fees (staking revenue to DAO)

The projected decline -8% in the fee base (Fee – Gross Staking Rewards and Gross Revenue) indicated in USD compared to the actual 2025 figures is primarily driven by the conservative ETH price assumptions used in the 2026 revenue forecasts, and is offset by improvements in Cost of Revenue (staking rewards to NOs), so that Net revenue from staking fees (staking revenue to the DAO) remains resilient. The 2026 revenue projections are intentionally cautious: although an increase in Lido’s market share next year is expected, the Lido Protocol Core revenue for 2026 is set at $35.1M which is below the actual 2025 Lido Protocol revenue of $41M. This conservative stance (built on 2-year median ETH price assumptions and cautious APR estimates) ensures resilience in various market conditions and avoids overstating expected performance.

Growth-oriented projects like stVaults, the Lido Core Upgrade, and additional income from activities under ‘Expand the Staking Ecosystem’ goal are expected to add approximately $10.2M to the projected Lido Protocol Core revenue. Thus total expectations on revenue from staking are set at the level $45.3M for 2026 (vs $41.0M in 2025).

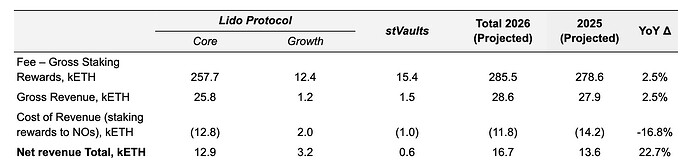

To isolate the impact of the ETH price assumption in Staking Revenue, it is necessary to analyze the 2026 projected figures relative to the 2025 data in ETH terms:

Expected Gross Staking Rewards for 2026 are 285.5 kETH, including 15.4 kETH from stVaults, compared to 278.6 kETH in 2025 (+2.5%). A similar level of change is expected for Gross Revenue in ETH. On top of that, a significant impact on DAO Net Revenue is expected from the Lido Core upgrade, which is assumed to significantly decrease Cost of Revenue line (changing staking rewards to NOs). Total effect on projected net revenue is +3.2 kETH in Growth part.

[2] Other Revenue

Additional revenue in 2026 is expected from new products such as Lido Earn and New Bets as well as from treasury management activities. Together, these inflows are projected to contribute an additional $8.6M.

[2.1] Revenue from Lido Earn and New Bets is based on assumptions described in EGG’2026 proposal.

[2.2] The revenue from Treasury Management is included based on the DAO-approved proposal TMC-6: ‘Convert DAO Treasury stablecoins into sUSDS and update the configuration on Easy Track and Aragon Finance accordingly”. Other revenue also includes Staking Rewards on Treasury stETH holdings which are expected at the amount $2.5M in 2026 vs $2.3M in 2025.

[3] Expenses

The structure and composition of expenses in 2026 will change as a result of investments into strategic growth objectives: the total spending on Growth and Liquidity will nearly double compared to the previous year, and, in addition, the expense structure will now include allocations from the Discretionary Costs pool (the discretionary part of the Growth budget).

Core expenses are expected to decrease by roughly 17% year-over-year: operating costs in 2025 amount to $32.4M, while the 2026 Core baseline assumes $26.9M. This reduction is achieved without compromising protocol maintenance or security, indicating improved cost efficiency and operational discipline. As a result, Core profitability increases meaningfully: under the 2026 baseline, the DAO is expected to generate $8.1M of Core total surplus for the Lido Protocol segment, even under conservative ETH price assumptions.

To support expansion, Growth spending increases not only in baseline costs but also in expected high variable expenses, requested as Discretionary Costs pool for hard-to-predict or unexpected costs. Given the high variability of such expenses, they may not be fully utilized over the next year; however, they are included in the current analysis to demonstrate the most conservative approach to forecasting results.

Discretionary Costs are the primary driver of the potential negative total financial outcome 2026. Consequently, the forecasted net loss for the coming year is attributable to the DAO’s strategic investment initiatives as well as the deliberately conservative assumptions applied in estimating forward-looking financial performance.

[4] Treasury

The DAO Treasury is projected to decline from $118.7M in 2025 to $112.6M in 2026 (–5% YoY). This change is primarily driven by a reduction in the USD value of the stETH Treasury position, which decreases from $91.2M to $85.1M (–7%). For comparability the model applies a budget assumption of $2,712 per stETH, based on the two-year median price. This conservative valuation framework significantly influences the USD-denominated Treasury figures.

In nominal terms, the DAO’s stETH holdings decrease from 33,628 to 31,365 stETH (–7%), reflecting the planned use of stETH to fund operations and growth initiatives throughout 2026.

The stablecoin portion of the Treasury remains constant at $27.5M in the model. We assume a stablecoin reserve of similar size in 2026 for modeling purposes. The Treasury Management Committee oversees any adjustments to the reserve under its established framework; this table reflects a steady balance for clarity and comparability.

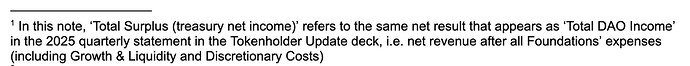

Comparative Analysis of EGG 2025 and EGG 2026

The most important change introduced this year is the consolidation of grant requests into one unified submission. In 2025, grants were distributed across multiple independent committees, each with its own budget, processes, and reporting.

Here is the list of grants requested in 2025:

- $11.1M for Q1 ’25 expenses

- $34.88M for Q2–Q4 ’25 expenses (per Lido Labs Foundation request)

- $10.61M for Q2–Q4 ’25 expenses (per Lido Ecosystem Foundation request)

- $0.3M for Q1–Q4 ’25 expenses (per Lido Alliance BORG)

- $0.5M LEGO Committee ongoing grant with quarterly renewals

- $2M bug bounty (per Lido Contributors Group request)

- $8.5M Liquidity Observation Lab 6-month grant

- $0.3M Delegate Incentivization Programme grant

- $0.2M Community Lifeguards Initiative (CLI) Quarterly Budget Request

- Remaining balance from 3,000 stETH for the Rewards Share Program approved in 2024

This fragmentation made it difficult to assess total spend, track performance across workstreams, and maintain consistent financial controls.

In 2026, the DAO moved to a unified model in which all committee-aligned workstreams are organized under the Lido Labs Foundation, Lido Ecosystem Foundation, and Lido Alliance BORG. As a result, the 2026 grant request is structurally different from the 2025 requests, and should not be interpreted as a simple year-over-year continuation. Categories, cost centers, and strategic priorities were redefined in accordance with GOOSE-3.

This structural shift is reflected clearly in the composition of both Core and Growth funding. In 2025, the Core portion of the EGG captured a wide range of legacy commitments. In 2026, Core funding is deliberately narrowed to cover only protocol-critical functions: engineering, audits, validator operations, risk management, infrastructure, and essential G&A. This redefinition explains the sharp decline in Core baseline from $58.9M to $26.9M.

In EGG 2025, Growth spending was dominated by liquidity incentives and RewShare programs, with very limited allocations toward building new products. In contrast, EGG 2026 introduces product-oriented categories that did not exist in the 2025 structure. These include stVaults, Lido Earn, institutional integrations, launch of vertical expansion initiatives, and a structured discretionary pool tied to product performance milestones. This aligns directly with the GOOSE-3 mandate to scale new DAO revenue streams and evolve Lido from a single-product protocol into an organization with a diversified product portfolio.

Disclaimer

The figures, projections, and evaluations presented in this report are estimates only and should not be interpreted as financial promises, commitments, or guarantees of future performance. All forward-looking statements are based on current assumptions, market conditions, and available data, and are subject to significant uncertainties and potential changes. All metrics and projections should therefore be viewed as informational and indicative rather than definitive forecasts.