upd: This proposal was updated on 10 Dec 2025.

This proposal has been updated to reflect changes in the Discretionary Cap (from $14.4M to $16.2M) and the total Foundations’ grant request (from $58.2M to $60.0M). The original amounts are replaced with the revised figures. A detailed explanation of why these changes were made is provided in the comment below.

TL;DR

- The 2026 Ecosystem Grant Request (EGG) is submitted to ensure protocol resilience, security and continuity, and to support Lido DAO’s long-term treasury growth.

- The 2026 EGG is a consolidated submission from Lido Labs Foundation, Lido Ecosystem Foundation, and Lido Alliance BORG (collectively the “Foundations”), aligning their mandates and execution plans to maintain protocol operations and deliver the proposed GOOSE-3 goals:

- Expand the Staking Ecosystem

- Ensure Protocol Resilience: Lido Core Upgrade

- Scale New DAO Revenue Streams: Lido Earn

- Explore Vertical Expansion and Real-World Business Applications.

- This request is structured into Core for protocol maintenance and Growth for new strategic initiatives with low-variance and high-variance components.

- The Foundations request

$58.2M$60.0M in total:- $43.8M baseline amount ($26.9M – Core; $16.9M – Growth)

$14.4M$16.2M discretionary amount cap under the Growth Part.

- Projected baseline revenue amounts to

$48.7M$50.0M, with upside potential from Growth initiatives and allocation of discretionary expenses. - Revenue projections are based on mildly conservative assumptions: ETH at $2,712 (2-year median price between Nov 2023 and Oct 2025), 2.93% staking APR, total ETH staked +15% to 41M ETH with Lido’s share rising to 27.3%, including 10.1M ETH staked via Lido Core and 1.05M ETH staked via stVaults.

- Baseline net income is expected to be

+$4.9M+$6.2 in 2026 (Core: +$8.1M; Growth:–$3.2M–$1.9M) - An additional request may be submitted to the DAO for the GOOSE-3 Big Bet if a validated, billion-dollar-scale opportunity emerges.

- GOOSE-3 and the 2026 EGG are included in a single voting slot to directly tie funding to objectives and simplify governance.

1. Introduction

This 2026 Ecosystem Grant gRequest (“EGG”) sets out the funding required to execute GOOSE-3 strategic plan for 2026 to support the Lido DAO (the “DAO”) in furthering the Lido protocol (“Lido” or “Protocol”).

The DAO’s mission of building a secure, decentralized, and simple liquid staking protocol for Ethereum is largely complete (see Lido on Ethereum Scorecard). The proposed focus for the Foundations in 2026 shifts towards evolving Lido’s position from a single-product protocol focused on liquid staking to an innovative organization with a product portfolio by expanding the product offering, creating new revenue streams and ensuring long-term protocol resilience. These proposals are designed to support both:

- Vertical expansion: building end-user products that capture more value, deepen relationships with existing user base and increase strategic resilience;

- Horizontal expansion: developing products related to stablecoins and other asset classes to broaden demand and diversify revenue.

The integration of the EGG and the Guided Open Objective Setting Exercise (GOOSE) proposal into a single voting slot aims to give LDO holders a clear mapping between requested funds, proposed strategic objectives, and measurable outcomes. This approach simplifies governance and strengthens accountability.

This submission has been prepared by the Lido Labs Foundation and reflects a collective request from Lido Labs Foundation, Lido Ecosystem Foundation and Lido Alliance BORG. These are independent entities, each of which has previously received grants from the Lido DAO to support its specific mandate towards the Lido protocol.

Since their mandates intersect and require ongoing collaboration, the 2026 EGG is unified and reflects how the Foundations propose to jointly deliver protocol maintenance and execute on the GOOSE-3 goals.

2. Foundations Grant Request 2026

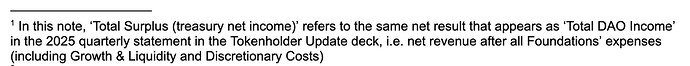

The 2026 EGG consists of two components: (i) Core, funding protocol-critical maintenance and operations, and (ii) Growth, funding the execution of the four proposed GOOSE-3 goals. Growth spend is divided into:

-

baseline costs (which are predictable low-variance spending with high likelihood of occurrence, such as maintenance, operations and validated initiatives), and

-

discretionary costs (which are high-variance optional or conditional allocations with uncertain realization, such as reserves and growth allocations that may be deployed only under certain conditions, and have a moderate or lower likelihood of occurrence).

The Foundations request $60.0M in total to execute Protocol maintenance and GOOSE-3 goals in 2026. This includes $43.8M in baseline spend: $26.9M (61%) for the Core and $16.9M (39%) for the Growth. And discretionary allocations for the Growth part include $16.2M.

If the proposal is supported, funding for disbursement to finance the Foundations would be requested from the DAO via Easy Track motions to the operational multisigs.

In the event that unused grant funds remain at the end of the period, they will be returned to the DAO Treasury.

2.1 Core (Protocol Maintenance) - Baseline costs

The Core funds the stability, reliability and security of the Lido protocol. It remains the anchor of Lido protocol resilience, DAO revenue stability and long-term sustainability.

The Lido protocol has maintained a zero-incident record related to the safety of users’ funds, a track record that reflects an uncompromising commitment to security and operational excellence and explains why the majority of Core spend is directed toward R&D and audits.

Maintenance covers the day-to-day operation of the protocol: keeping smart contracts and offchain components up to date with Ethereum upgrades, running 24/7 monitoring and alerting, providing tooling and support for hundreds of node operators. The request funds the engineering, DevOps, risk and support functions that deliver these activities, as well as the audit and infrastructure layers that enable them to meet strict reliability and security standards.

While variable costs in this category remain relatively low, the request includes essential allocations for audits and market-level base compensation, needed to operate a protocol of this scale and complexity. These costs are fundamental to ensuring continuous performance, rapid issue resolution and proactive risk management.

If protocol-related workloads decrease during the year (for instance, if certain upgrades are completed ahead of schedule or deprioritized), capacity may be reallocated towards Growth initiatives. This flexibility ensures optimal utilization of skilled resources and supports the broader DAO treasury’s revenue growth objective for 2026.

2.2 Growth – Baseline costs

2.2.1 Expand the Staking Ecosystem

To deliver the Expand the Staking Ecosystem goal, the Foundations request $10.8M. These funds will be directed toward strengthening adoption of stETH and stVaults, with a particular focus on Lido V3 stVaults and institutional, ETF/ETP and DeFi integrations. Funding will support the build-out and iteration of the stVaults infrastructure, onboarding of key institutional and DeFi partners, and running targeted go-to-market efforts to drive adoption.

Most of the costs under this goal are low-variance R&D expenses ($2.5M), including compensation for the stVaults development and audits work ($0.8M reflected in Indirect Costs). Sales and marketing costs ($1.2M) support expansion of the stVaults and broader stETH offering, including ETF/ETP distribution.

Lido V3 stVaults represent one of Lido’s largest strategic investments. Following the launch of the initial stVaults and a period of live operation, the Foundations will need to determine whether this product line should remain a focus of active development and scaling, or transition into a maintenance posture on supporting existing users and integration. This decision is expected around Q2 2026, once stVaults have been fully rolled out and progress can be assessed.

The Growth part also includes a request for funding to support the Rewards Share Program. At the moment, the Rewards-Share Committee continues an existing grant (3,000 stETH until exhausted or the program is stopped) to further help raise liquid staking technology and liquid staking tokens such as stETH awareness. Next year, an additional ~1k ETH will be required to cover current and potential commitments, which amounts to $2.9M based on median ETH price over the last 2 years used in the current EGG.

Liquidity Costs represent expenses aimed at strategically boosting liquidity in crucial stETH applications, supporting potential integrations that can strengthen the stETH ecosystem, and implementing temporary liquidity measures with clearly defined objectives. This category includes future expenses tied to existing commitments or commitments with high likelihood of occurrence. The total amount of such expenses is $3.2M.

2.2.2 Ensure Protocol Resilience: Lido Core Upgrade

To deliver the Ensure Protocol Resilience: Lido Core Upgrade goal, the Foundations request $3.0M. These funds will be directed toward delivering Curated Module v2 (CMv2) and Staking Router v3 (SRv3) with ValMart — a validator-market built directly into the routing layer that replaces round-robin allocation with a system where operator fees, validator performance and decentralization metrics determine how stake is routed.

Almost the entire allocation consists of low-variance R&D and audit expenses ($2.7M combined), covering the full design, implementation, maintenance and audits of CMv2, SRv3 and ValMart.

This includes implementing CMv2 features such as operator bonding and performance-linked allocation and exit priority; SRv3 improvements including granular deposit and withdrawal controls, stake reallocation between operators and modules, and balance-based accounting across validator types; the staged transition from the current Curated Module to CMv2; and the audits required to safely ship the upgraded routing layer.

2.2.3 Scale New DAO Revenue Streams: Lido Earn

To deliver the Scale New DAO Revenue Streams: Lido Earn goal, the Foundations request $1.8M. The allocation supports the development of Lido Earn into a multi-segment product suite that serves different yield appetites and risk profiles. In 2026, work under this goal will focus on expanding and maintaining Earn vaults for DeFi users, restakers, stablecoin savers, passive earners and treasury managers.

Almost the entire allocation consists of baseline R&D and audit expenses ($1.6M combined), covering the full design, implementation and maintenance of the Earn product line.

Most costs under this goal are low-variance R&D expenses. It is expected to:

- Design, launch and maintain Earn vaults across the targeted user segments listed above;

- Implement and support the DeFi and DVT-based strategies used by these vaults;

- Develop and maintain ERC-4626 wrappers for Earn vaults so they can be used in external structured DeFi products;

- Maintain and update the smart contracts and related infrastructure required for Earn to function as a stable product line for the DAO;

- Facilitate integrations and support distribution through channel partners, enabling Earn vaults to be embedded, listed, and promoted across external interfaces and partner ecosystems.

For Lido Earn, a separate pool of high-variance costs is requested as part of the Conditional allocations with uncertain realization (see Section 3), with the actual spend depending on the product’s performance and traction. This reserve is intended to cover potential marketing-related expenses, business development and collaboration with partners, notably to source vault incentives into Earn products.

2.2.4 Explore Vertical Expansion and Real-World Business Applications

To deliver the Explore Vertical Expansion and Real-World Business Applications goal, the Foundations request $1.3M. This allocation supports the small-bet track defined in GOOSE-3: fast, lean initiatives with strict validation gates. Only experiments demonstrating clear traction and revenue potential will be eligible to scale and receive additional allocation. The intent is exploration of optionality, not permanent overhead.

2.3 The Big Bet Funding

According to the GOOSE-3 goal Explore Vertical Expansion and Real-World Business Applications, the Foundations will explore a potential “Big Bet” – a major expansion with billion-dollar revenue potential.

As the required resources cannot be reliably estimated today, no funding is requested at this time. The Foundations may return to the DAO with a separate request if a strategically compelling opportunity emerges, with the size of any such request determined by the specifics of that opportunity.

3. Discretionary Costs

Conditional allocations with uncertain realization

To deliver on the GOOSE-3 goals Scale New DAO Revenue Streams: Lido Earn & Explore Vertical Expansion and Real-World Business Applications aimed at expanding Lido’s product portfolio beyond staking and continue development of the stVaults product line (if conditions for continuous active investment are met), the Foundations plan to undertake a wide pool of initiatives.

To adequately budget for associated expenses, these projects undergo an initial assessment to determine their expected utilization rate and to classify the corresponding portion as either baseline or discretionary costs. These utilization assumptions for each product line and expense category inform the allocations included in this EGG Request.

While the total discretionary costs could potentially reach $27.4M in the event of a highly positive market response, we are requesting an initial allocation of only $16.2M at this stage.The Foundations intend these funds to be held in reserve as part of a pool to be allocated based on the market response to the new initiatives. Such reserves will only be deployed when predefined product milestones (e.g. TVL, revenue run-rate, partner commitments) are met and may not be fully utilised. Unsuccessful experiments will be sunset, in line with the execution model described in GOOSE-3.

Therefore, the total grant requested for the Growth discretionary costs is $16.2M.

These allocations include:

- Potential liquidity costs

- Expenses related to potential institutional integrations

- Costs of potential new hires that may be required as products grow

- Incentives and bonuses that are closely tied to the performance of individual products

- LEGO grants to third parties, which may be issued if the Foundations deem them necessary

- Costs of auditing new products, which may arise in case of success

- Legal and marketing expenses, which also depend on the success of the chosen growth directions

- This also includes a buffer to allow for decision-making, should the need arise.

4. Projected impact on DAO Treasury

4.1 Main economic assumptions

The 2026 EGG is built upon a baseline scenario, which incorporates a set of assumptions designed to facilitate realistic and prudent financial planning.

Baseline scenario

- Cautiously optimistic on growth

- Total ETH staked grows 15% to 41M ETH, as a result of institutional adoption and expected regulatory approval of US ETF staking

- Lido Core grows 17.3% to 10.1M ETH staked, driven by new integrations - ETPs, custodians, and exchanges

- stVaults grow to 1.05M ETH staked as node operators, wallets, custodians, L2 ecosystems and other integrators build staking and structured DeFi products on top of stVaults infrastructure

- Thus, Lido’s market share is expected to reach 27.3% (compared to the current Lido market share of 24.1%).

- Realistic on DAO fee rate changes:

- DAO share of staking rewards weighted across the Core protocol modules increases by ~20%, from 5.02% to 6.02%, as a result of changes proposed under the GOOSE-3 “Ensure Protocol Resilience: Lido Core Upgrade” goal, and CSM reaching 10% of Lido Core

- DAO blended share on stVaults assumed at 3.59%, consisting of 1% flat infra fee + 6.5% liquidity fee on minted stETH, assuming 65% users mint conservatively (15% of ETH staked) and 35% users mint aggressively (95% of ETH staked)

- Cautiously pessimistic on ETH/USD price = $2,712, the median price over the last 2 years, chosen to ensure resilience even during market turbulence. At the date of publishing, the median price is ~$2,842, which represents only a minor deviation (within 5%) from the price used for the financial planning.

ETH price remains the most impactful variable for Lido DAO’s revenue projections. It is considered that the assumptions underlying the baseline scenario render it appropriately cautious.

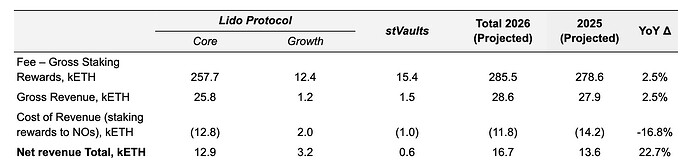

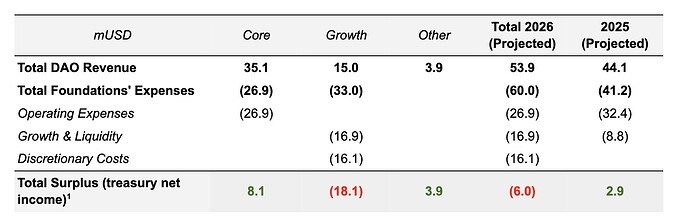

4.2 Overall Lido DAO revenue impact

The figures shown above represent cumulative DAO revenue for 2026. GOOSE-3 instead defines product goals in terms of year-end annual recurring revenue (ARR), so these numbers are not directly comparable.

Based on baseline spend and baseline revenue assumptions, approximately +$8.1M in net impact for 2026 is expected to be generated in Core and -$1.9M in net impact in Growth, resulting in treasury net impact of +$6.2M. This strengthens the treasury and preserves long-term optionality for future initiatives.

It is important to emphasize that all revenue mentioned belongs and flows directly to Lido DAO’s treasury and not to any of the Foundations, as the Protocol is governed by the DAO. Any revenue figures included in this proposal are only projections based on the assumptions laid out and do not constitute commitments or guarantees. These projections depend heavily on multiple external and internal factors which are unpredictable and fall outside of the control of the Foundations, including market conditions, product adoption and the execution timelines. Accordingly, no revenue targets are being promised as part of this EGG. All figures should be treated as indicative estimates rather than firm expectations.

4.2.1 Core Revenue

The core staking product – Lido protocol is the primary source of revenue for the Lido DAO.

Core revenue is estimated to reach 35 061 kUSD, taking into consideration the following assumptions:

4.2.2 Growth Revenue

The figures below represent a high-confidence baseline based only on existing projects; internal targets are higher, and the Foundations are working on additional initiatives under the 2026 goals outlined in the GOOSE-3 proposal. Discretionary expenses associated with these additional initiatives, if allocated, are expected to generate extra revenue beyond this baseline.

4.3 Risk Profile

The risk profile of the grant request is shaped by three design choices:

- Core first protection: protocol safety and continuity remain fully funded under all scenarios

- Conditional deployment: reserves set aside for discretionary expenses are unlocked based on product traction, market conditions and clear milestones. If those conditions are not met, these funds remain in the Lido DAO Treasury.

- Downside flexibility: Treasury depletion is avoided by prioritizing the Core funding and scaling back Growth; high-variance spend is reduced or delayed, and lower-confidence initiatives are paused first if DAO revenues soften or market conditions weaken.

This structure ensures the DAO strengthens its treasury while executing GOOSE-3 in a risk-aware way.

5. Closing words

The Foundations request $60.0M to secure protocol continuity and deliver GOOSE-3 goals in 2026: $43.8M in baseline ($26.9M Core, $16.9M Growth) and $16.2M in discretionary funding deployed only if milestones are met.

Core funding ensures uninterrupted operation of the Lido protocol, the DAO’s primary revenue engine, across engineering, infrastructure, validator operations, and security. This layer is fully protected under all market conditions.

Growth funding targets GOOSE-3 execution: expanding the staking ecosystem, shipping Core upgrades (CMv2, SRv3, ValMart), scaling Lido Earn, and running selective vertical expansion bets. These unlock new DAO revenue lines, deepen product-market fit, and strengthen DAO resilience.

Under baseline assumptions, the DAO remains net impact positive. Conditional reserves are gated by measurable traction such as TVL, revenue, integrations ensuring disciplined capital deployment and downside protection.

This proposal strengthens protocol safety, funds strategic delivery, and preserves optionality for the next chapter. Lido now has the opportunity to shape not only the future of staking, but the future of onchain financial infrastructure.

upd. 10 December 2025

This proposal has been updated to reflect changes in the Discretionary Cap (from $14.4M to $16.2M) and the total Foundations’ grant request (from $58.2M to $60.0M). The original amounts are replaced with the revised figures.

Why these changes were made:

Following the Curated Module Fee Changes vote, the default operator fee in the Curated Module will shift to 3.5% from 5% previously. Until Curated Module v2 introduces automation, extra-tier (Extra Effort and Client Team Tier) rewards above the base 3.5% fee must be distributed manually. To enable this, 487.5 ETH ($1.3M) are requested for the Reward Share Committee to process these. This additional request does not change the expected financial outcome for the DAO or the protocol, as it is a consequence of a temporary manual process for Lido Core until CMv2 is live (note: this change in Lido Core is a part of anticipated additional net revenue for the year (from $7,012k to $8,334k) resulting from fee adjustments.

Additionally, 150 ETH ($0.5M) is requested to fund the Lido stVaults Rewards Share, which the Rewards Share Committee will also process. This Rewards Share is intended to support the adoption of stVaults and help grow Lido’s penetration in the low-risk staking segment.

In total, this adds 637.5 ETH to the request, increasing Discretionary Costs by $1.8M.