Summary

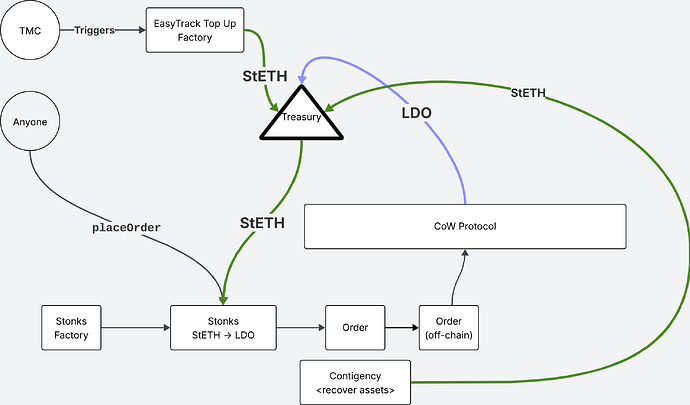

NEST is a modular extension of STONKS that, when filled with stETH, incentivizes a keeper to fire a STONKS Cowswap order of stETH for LDO and routes it back to the Lido DAO treasury, effectively taking it out of circulation. The net effect it has is essentially to change the respective share over governance rights that holders enjoy, including over future ‘value distribution’ proposals.

Introducing NEST

NEST proposes a modular and future-proof system that can automatically trigger repurchases of LDO and can provide programmatic enforcement guarantees to token holders for the future. As-written, it would require Aragon DAO votes for specific quantums of stETH to be deposited in NEST to activate. The idea is that a future, automated, module could ‘feed’ the NEST with stETH under any other parameters, including automated ones.

Any stETH available in NEST is subject to have 1 STONKS Cowswap order created for it at a minimum every 7,000 blocks, or approximately once a day. The maximum order size possible is configurable through an Aragon DAO vote and should aim to avoid slippage greater than 1% in a single transaction. Successfully triggering a new STONKS order rewards the address that executes the transaction with 2bps of the order size prior to execution, in stETH. These parameters can and probably will be modified depending on market conditions nearer to deployment.

| USD Equiv. | STETH Sold | LDO Received | LDO Estimated | Price Impact |

|---|---|---|---|---|

| 1,000 | 0.2 | 821 | 822 | -0.03% |

| 2,500 | 0.6 | 2,054 | 2,055 | -0.04% |

| 5,000 | 1.2 | 4,109 | 4,111 | -0.04% |

| 10,000 | 2.3 | 8,216 | 8,222 | -0.07% |

| 25,000 | 5.8 | 20,540 | 20,550 | -0.05% |

| 50,000 | 11.6 | 41,066 | 41,105 | -0.10% |

| 100,000 | 23.1 | 82,036 | 82,214 | -0.22% |

| 150,000 | 34.7 | 123,034 | 123,332 | -0.24% |

| 200,000 | 46.2 | 163,927 | 164,443 | -0.31% |

| 250,000 | 57.8 | 204,818 | 205,555 | -0.36% |

| 300,000 | 69.4 | 245,876 | 246,664 | -0.32% |

| 400,000 | 92.5 | 318,441 | 328,872 | -3.17% |

| 500,000 | 115.6 | 394,643 | 411,104 | -4.00% |

| 600,000 | 138.7 | 467,698 | 493,328 | -5.20% |

| 700,000 | 161.8 | 557,462 | 575,553 | -3.14% |

| 800,000 | 185.0 | 629,873 | 657,777 | -4.24% |

| 900,000 | 208.1 | 698,936 | 740,000 | -5.55% |

| 1,000,000 | 231.2 | 765,416 | 822,214 | -6.91% |

The prices and percentages provided are estimations serving informational purposes only and are based on current assumptions and projections. They do not constitute financial advice, investment advice, or a guarantee of future performance. Actual outcomes may vary. All individuals should conduct their own research and consult with a qualified advisor before making any decisions.

Key Takeaways

-

Implements an explicit mechanism to establish the credibility of surplus allocation

- Programmatic and optimistic execution is a stronger guarantee than leaving it up to ad-hoc token holder votes (mechanism that exists and could be enacted today with sufficient votes)

-

Retains primacy of LDO

- Delegates and regular LDO voters could at any time change the parameters to stop NEST allocations or remove it from the protocol altogether

-

Stacks and synergizes with any other tokenomics changes, value allocation proposals or one-time allocations of surplus

- NEST takes any value allocation mechanisms in place (whether implicit as today or explicit new ones in the future) and changes the share of the claim that each token represents on it

Future modules

-

The proposal suggests a modular architecture that could accommodate future modules and extensions to deposit stETH into NEST

- Any stETH deposited on NEST would eventually end up as LDO in the Aragon treasury

-

One such module could, for instance, be an automation that pulls out any surplus over a token holder defined threshold

- It could also, for instance, use oracles to set execution limits based on market prices of LDO/ETH, i.e. to only allocate surplus if the LDO/ETH price is lower than historical bounds

-

Further opportunistic, one-time allocations could be enabled through additional Aragon votes

-

A similar NEST could also be deployed for the reverse flow to issue and mint LDO for stETH if there are future market conditions where the LDO/ETH multiple may appear inflated

We invite further discussion on how exactly automations of such an execution could work.

Proposal actions

This proposal requests:

-

Approval of the NEST mechanism as described

- This proposal sets a desire to see a stETH->LDO NEST module researched, proposed and built

-

Final designs will have to be subject to DAO approval and the final release will be subject to an Aragon execution when the time comes

-

Parameters of NEST may also require Aragon votes to complete, and can be discussed at a later stage prior to execution

-

Ratification of this proposal does not imply that these specific proposed parameters should be enacted.

-

This proposal does not suggest enacting a first distribution. We suggest that deployment and use of NEST to enact any distribution programs be discussed in a further proposal once NEST is ready and nearing deployment.