As part of the GOOSE 2025 retrospective, we’re publishing this detailed progress report prepared by the Lido Labs Foundation, a DAO-adjacent organization. The Foundation received grant funding to contribute toward the 2025 annual goals set by GOOSE-2, and now it reports on the progress achieved. Covering the period from January 1 to September 16, 2025, the report highlights stETH ecosystem evolution, product line expansion, progressive validator set decentralization, advances in governance, and LDO tokenomics.

Report

TL:DR

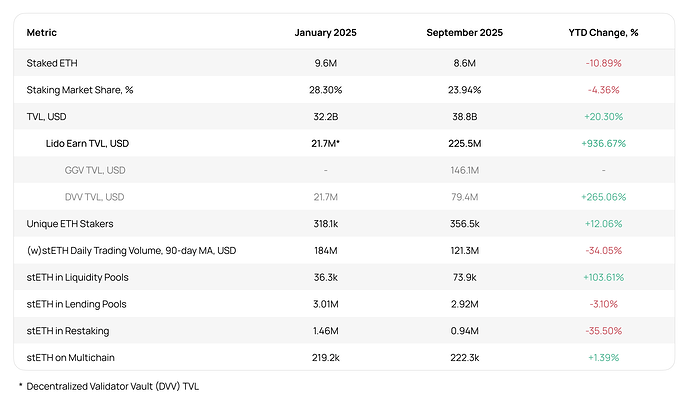

- stETH & Ecosystem - despite 1.05M ETH in staking outflows and market share drop to 23.9%, Lido protocol TVL reached $38.8B due to ETH price growth. Ecosystem remained resilient with DEX reserves +104%, lending and L2/altchains bridges stable. Restaked stETH -35%, following the broader restaking market.

- Product Expansion - Lido Earn surpassed $225M in TVL within two weeks of launch, led by the new GGV vault (automated DeFi strategies), which attracted $146M in new deposits, while the older DVV vault (boosting distributed validators) contributed $79M. stVaults, now on testnet, are expected to go live with Lido V3 in Q4 ’25. stVaults will expand the protocol’s addressable market by enabling customizable staking setups better suited to institutional and reward-seeking stakers - a GOOSE-2 goal. stVaults are crucial enablers of institutional adoption, and have already found purchase demand in novel initiatives such as Mellow wstETH restaking vaults and Linea’s Native Yield mechanism.

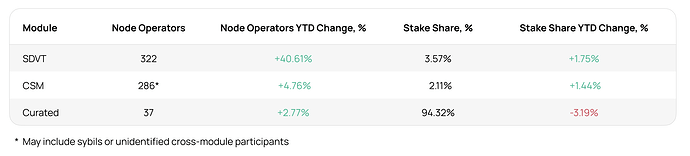

- Validator Set - unique Node Operators +21% YTD to 617. The Community Staking Module (CSM) became fully permissionless (GOOSE-1 target), now at 2.1% stake share and SDVT (Simple DVT) Module - at 3.6%. CSM v2 and triggerable withdrawals support (EIP-7002) went live in October, adding bad-performance strikes for ejection of underperforming validators, community stakers identification framework and improving performance oracle. Additional validator and node operator metrics can be found in the quarterly updated Lido Validator and Node Operator Metrics (VaNOM) tool.

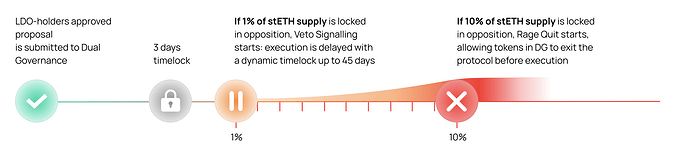

- Governance - Dual Governance went live in July, adding an objection mechanism for stETH holders that can delay proposal execution via a dynamic timelock. At a higher threshold of opposition, Dual Governance enables a pause on DAO execution until objectors redeem ETH and exit the protocol. In this way Dual Governance strengthened protection against governance attacks and completed the GOOSE-1 goal. Active voting power dipped slightly, but quorums have been consistently met with only 2 misses.

- Tokenomics - the NEST proposal introduces infrastructure for potential LDO repurchases using stETH, aligning long-term incentives with tokenholders - delivery on the GOOSE-2 goal. The next step is to open a focused discussion on how to put these rails to use for buybacks.

- Lido Scorecard Update - with live Dual Governance and CSM permissionless entry, all items from the Lido on Ethereum Scorecard now have either a “good” or “okay” status.

- Funding – as at August 31, $21.5M has been spent in operational expenses out of the DAO-approved $58.6M ceiling (36.6% utilization). Liquidity Observation Labs spent $3.9M of its $17.0M ceiling, while the Rewards Share Committee distributed 770 stETH to Rewards-Share Program participants, leaving 1,038 stETH remaining in the program’s pool. Lido Labs and Lido Ecosystem Foundations are targeting $31.4M in annualized operational expenses for the rest of 2025, and up to 10-15% of the DAO Treasury (currently ~$174M, excl. LDO) as the annual range for growth and liquidity initiatives.

stETH & Product Line Expansion

GOOSE-1 set the goal of making stETH the most used token in the Ethereum ecosystem by expanding its utility. In 2025, this ambition advanced with new integrations. The launch of Lido Earn and development of stVaults - expected to go live in Q4 ’25 - mark progress on GOOSE-2’s goal of evolving from product to product line and open new pathways for institutional and retail adoption.

Since January, the Lido protocol recorded 1.05M ETH in staking outflows, leading to a market share decline from 28.3% to 23.9%. Key reasons behind these outflows include:

- Regulatory environment - in early 2025, delegated and custodial staking benefited from a head start. The SEC clarified the status of solo/self, delegated, and custodial staking in May, but only issued a statement on liquid staking in August

- ETH absorption by ETFs & Digital Asset Treasury Companies (DATCOs) - crypto-native users sold ETH as its price grew, while new demand came from ETFs and DATCOs. The US ETFs do not currently stake ETH and this diverted ETH away from liquid staking. DATCOs look for tailored staking products - this is a new market segment to be addressed with stVaults after Lido V3 launch

- Staking APR compression - Staking APR decreased as total ETH staked grew and L1 scaling reduced MEV opportunities. This motivated a portion of users to migrate to higher-APR, higher-risk products. At the same time, competition from LRT looping strategies drove up ETH borrow costs on lending markets, putting pressure on stETH looping strategies

stETH reserves in DEX liquidity pools rose 104%, while collateral use on lending markets and amount on the bridges to L2s and altchains remained mostly stable. Restaked stETH fell 35%, echoing the overall decline of the restaking market.

From January through August 2025, the DAO’s share of Lido protocol staking rewards amounted to 9,649 ETH ($26.4M), a 16.6% decline compared to the same period last year, caused by the staking outflows and staking APR compression.

The underlying drivers of the decline were examined in detail during the first Tokenholder Call, which introduced a segmentation of the staking market into APR-maxis, simple LST, exchange, and low-risk segments to better contextualize Lido protocol’s positioning. Alongside that framework, a targeted growth strategy was also laid out, focused on re-engaging the APR-maxis segment, strengthening institutional adoption, and expanding product surface for the low-risk staking segment. Several components of that strategy are already live.

Two weeks after launch, Lido Earn, a new gateway for stETH-powered DeFi and staking strategies, surpassed $225M in TVL. This reflects strong market demand for the newly launched Golden Goose Vault (GGV) , which attracted $146M in fresh deposits, and continued confidence in the Decentralized Validator Vault (DVV) vault, live since 2024 and now integrated into the Earn product line, contributing $79M in TVL. GGV, powered by Veda Labs, provides automated access to advanced DeFi strategies through a simple interface. DVV, implemented by Mellow, accelerates DVT adoption as ETH deposits are allocated by the Staking Router across modules where constituent node operators utilize distributed validators powered by Obol or SSV, while vault stakers receive the majority of related Obol and SSV incentives. Together, these products expand stETH’s utility and improve ecosystem accessibility.

Strategically, Lido Earn serves to re-engage the APR-maxis and recapture the market share in this segment by meeting the market’s demand for high-reward products.

In August 2025, the US SEC issued a statement that certain liquid staking activities and transactions do not involve the offer and sale of securities, and that certain tokens that encapsulate these activities (“Staking Receipt Tokens”) do not constitute securities offerings. This increased regulatory clarity opens the way to broader institutional adoption for stETH and the new product line of stVaults, which will be introduced with the upcoming Lido V3 upgrade as a contribution toward the corresponding GOOSE-2 goal.

As at September 2025, Lido V3 is live on testnet and is going through the audit process. The mainnet launch is expected in Q4 2025.

Lido V3 introduces stVaults, modular infrastructure for customizable staking setups. They give stakers the power to choose node operators, while allowing node operators to set fee structures, risk-reward profiles, and other optimizations. At the same time, stVaults maintain the option of stETH liquidity with corresponding DeFi integrations. In this way, stVaults let institutional stakers access stETH through compliance-ready setups while retaining operational oversight.

The customizability of stVaults is key to unlocking the broader institutional market and positioning the Lido protocol to capture the next wave of institutional capital inflow coming to Ethereum. They are designed to directly address the demand for bespoke staking products, crucial for future adoption by vehicles like ETFs.

Node operators are able to develop staking products based on stVaults for all sizes of customers, offering features like validator setup customization and enhanced reward mechanisms. Asset managers can design structured products using stETH as high-quality collateral at the core of the Ethereum ecosystem.

In anticipation of Lido V3 mainnet launch, market participants are already signalling high interest in stVaults, and have commenced the building of customized products using V3 as underlying infrastructure:

- 38 early adopters have already launched wstETH restaking vaults with Mellow

- Linea plans to power their Native Yield mechanism by staking bridged ETH through stVaults

- Solstice is preparing a delta-neutral strategy leveraging stVaults

- Chorus One is working on standard and looped staking products based on stVaults

Throughout the year, stETH has continued its trajectory of new integrations with highly reputable and regulatorily compliant venues, such as qualified custodians, market makers, and institutional financial product providers. These partnerships build a network of on-ramps for institutional capital to enter the Lido ecosystem:

- Hex Trust (Sep 2025) - enabled stETH custody support and ETH staking via Lido protocol

- BitGo (Jul 2025) - enabled ETH staking via Lido protocol and direct stETH minting for users in Europe and Asia

- Caladan (Jul 2025) - integrated stETH as accepted collateral for institutional OTC and structured products

- Komainu (May 2025) - introduced multi-jurisdictional stETH custody with support for using stETH as collateral for off-exchange financing and settlement

- Crypto Finance AG (Jan 2025) - added custody support for stETH

Validator Set & Validator Marketplace

GOOSE-1 set the goal of the Lido protocol attracting the best validator set in the market, while GOOSE-2 extended this vision with the creation of a competitive open market for validators. In 2025, the Lido community advanced toward these targets by expanding its validator set across all modules, increasing the number of Node Operators and raising stake allocation toward community and DVT operators. The CSM became fully permissionless, the SDVT Module expanded further, and design work began on Curated Module v2 and Staking Router v3, laying the groundwork for a validator marketplace.

Total Unique Node Operators with active keys, excluding identified cross-module participation, reached 617 (+20.74% YTD); see the distribution per module below.

Additional validator and node operator metrics can be found in the quarterly updated Lido Validator and Node Operator Metrics (VaNOM) tool.

When the CSM graduated from its Early Adoption phase in January, entry into the Lido protocol’s validator set became fully permissionless. This update lowered the participation requirements for node operators to contribute to Ethereum’s security from 32 ETH to just a 2.4 ETH bond (or 1.5 ETH for early adopters) for each operator’s first validator. Democratized access allowed CSM to quickly reach its 2% stake share cap. The cap was recently raised to 3%, with a planned increase to 5% at v2 launch and potentially 10% by late 2025 or early 2026.

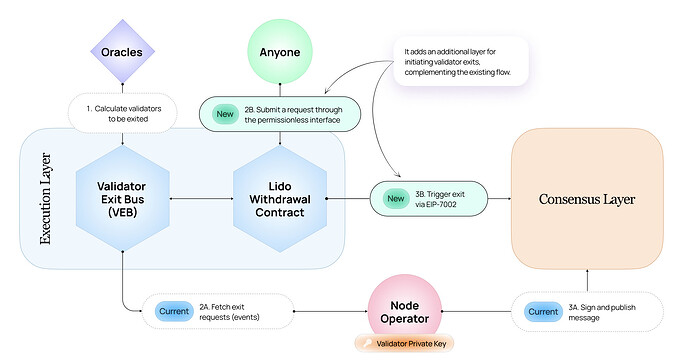

Triggerable Withdrawals, enabled by EIP-7002, and proposed to the DAO in September, introduce the ability to exit validators directly from the Execution Layer without requiring Node Operator action. This mechanism reduces reliance on operators, improves fault tolerance, and ensures that underperforming or failing to follow protocol rules validators can be securely and verifiably removed.

CSM v2 went live on October 2. Its design introduces multiple innovations, including a more precise Performance Oracle and a “bad-performance strikes” mechanism with triggerable withdrawals to eject underperforming validators. Additionally, it is the first module with built-in reward differentiation for different node operator types, a feature introduced through the Identified Community Stakers framework. This model uses fee tiers and queue priority to continue the enfranchisement of small participants in the Lido protocol and at the same time increase the sustainability and robustness of the protocol, and improve the DAO share of rewards for validators run through the module.

Design work also advanced on Staking Router v3 (SRv3) and Curated Module v2 (CMv2), which, tokenholder approval pending, are estimated to go live in H1 ‘26. Together, these put GOOSE-2’s validator market vision into practice by enabling fee competition, granular stake allocation and differentiated rewards based on operator type and decentralization contribution. These marketplace mechanics, combined with the intended baseline fee reduction for Curated Module Node Operators in late 2025-early 2026, are expected to increase staking fees captured by the DAO.

SRv3 — market mechanics & flexible accounting

- ValMart (validator marketplace) - competition for stake allocation factoring operator type, fees, performance, and decentralization contributions

- Granular control - technical support for stake reallocation between operators/modules; partial deposits/withdrawals; new deposits allocation into large validators

- Balance-based accounting - support for 0x01 & 0x02 validator types, enabling:

- Validator consolidations as a tool to be used for consolidating stake to larger validators, cycling to new validator keys, or reallocating stake

- Partial withdrawals and deposits for smoother protocol operations

- Lido Core to shift most of its stake to MAX_EB 2048 validators, supporting the desired decrease in network footprint to enable scaling and faster finality for Ethereum

CMv2 — performance, risk-management and economics

- Bonding for curated operators - reduction of the protocol’s overall risk profile, with impact on stake allocation

- Performance-based parameters - integration of a performance oracle to link allocation/exit priority within acceptable performance bounds

- Node Operator types & fee curves - differentiated types (e.g., client teams, underrepresented macroregions) plus customizable reward-share curves under DAO-set ceilings enabling operator fee competition

In terms of Ethereum hardforks, the Lido protocol navigated the Ethereum Pectra upgrade seamlessly in May 2025, with timely updates to all critical infrastructure and no operational incidents or interruptions to protocol functionality. Contributors are working on readiness for Fusaka on devnets, and are currently on track for the scheduled rollout on Hoodi testnet and mainnet later this year.

DAO Governance & LDO Tokenomics

GOOSE-1 set the goal of Lido DAO establishing effective and decentralized governance, while GOOSE-2 extended this vision by proposing LDO tokenomics reform as a driver of long-term alignment between the protocol and its tokenholders. In 2025, these ambitions advanced with the activation of Dual Governance, which introduced an objection mechanism on governance proposals for stETH holders, and with the NEST proposal, which aims to establish infrastructure for potential LDO repurchases.

Dual Governance was activated in early July, enabling stETH holders to oppose controversial LDO-governance decisions through a timelock mechanism, and exit the protocol before undesirable changes take effect. The level of opposition directly determines the length of the timelock: the stronger the objection, the longer the delay, creating time for corrective action, and for stETH holders to redeem ETH from the protocol before changes take effect.

Importantly, the activation of Dual Governance marked a key protocol milestone with all items from the Lido on Ethereum Scorecard now holding a ‘good’ or ‘okay’ status.

By introducing a unique rage-quit mechanism, Dual Governance seeks to safeguard stakers from adverse governance events. These features are especially relevant for risk-averse participants, as they increase the cost of potential attacks, aiming to set a higher bar for safety.

Active voting power declined moderately year-to-date: 72.9M LDO in Snapshot votes and 61M in Aragon in Q2 ’25, down 10% and 4% from Q4 ’24. This indicates that LDO realignment has not yet been achieved. Even so, quorums were met reliably this year, with only two exceptions.

The Public Delegates platform launched in 2024 has been instrumental in sustaining quorums and increasing the quality of discussion. The pilot incentivization program was earlier extended through year-end, with delegates showing high participation and collectively amassing over 16M LDO of delegated voting power.

To improve transparency and direct engagement, Lido Labs hosted its first Tokenholder Update Call on August 14, featuring a public livestream and Q&A session (report). The intent is to continue these sessions on a periodic basis, targeting a quarterly cadence, to keep community informed on the progress towards DAO strategic priorities

Finally, the NEST (Network Economic Support Tokenomics) proposal has been approved by the DAO vote. NEST outlines infrastructure for potential future LDO repurchases funded with staking fees via programmatic orders. Acquired tokens would be routed to the DAO treasury, reducing circulating supply. This aligns incentives between the protocol’s success and the LDO token, encouraging long-term holding and contributing towards the GOOSE-2 goal.

Note: while the NEST proposal creates infrastructure for repurchase transactions, concrete trigger conditions and repurchase parameters are yet to be determined in the coming months.

EGG Grants Funding

Note: Historically, growth and liquidity support initiatives (e.g., Liquidity Observation Labs and the Rewards Share Committee) have been reported separately. The same approach is applied in this report. Lido Labs and Lido Ecosystem Foundations intend to consolidate these grants into unified EGG requests to improve clarity and holistic reporting in future periods.

As at August 31, $21.5M in operational expenses had been spent out of the $58.6M ceiling previously approved across several allocations:

- $11.1M for Q1 ‘25 expenses + $2M bug bounty per Lido Contributors Group request

- $34.88M for Q2-Q4 ‘25 expenses per Lido Labs Foundation request

- $10.61M for Q2-Q4 ‘25 expenses per Lido Ecosystem Foundation request

Operational budget utilization stood at 36.6% as at end-August. Two primary factors contributed to the relatively low utilization rate:

- Total budget included $2M bug bounty - emergency reserves that remain largely unused to date

- The budget projection accounted for active hiring, which was scaled back in response to market conditions

By August 31, Liquidity Observation Labs had spent $3.9M out of the $17.0M ceiling previously approved in two allocations for H1 ‘25 and H2 ‘25.

The Rewards Share Committee continued distributions from the 3,000 stETH pool allocated in 2023. As at January 1 2025, the pool balance stood at 1,808 stETH. From January through August, 770 stETH was distributed to Rewards-Share Program participants, leaving 1,038 stETH on the balance.

To strengthen the DAO’s long-term sustainability, Lido Labs and Lido Ecosystem Foundations are targeting an annualized operational expense trajectory of $31.4M for the rest of 2025, while aiming up to 10-15% of the DAO Treasury (current value at ~$174M, excluding the LDO token balance) as the annual range for growth and liquidity support initiatives.

This report takes a holistic view of Labs, Ecosystem, and Alliance Foundations. While legally independent, the entities collaborate under intercompany agreements and this report reflects that joint effort.

What is GOOSE

The Guided Open Objective Setting Exercise (GOOSE) framework was adopted by the Lido DAO in September 2023.

Each GOOSE sets one-year and three-year goals aligned with the DAO’s mission and vision, making them public for anyone to work towards. The current set of goals for 2025 (GOOSE-2) was approved in November 2024.

Next GOOSE Cycle

For reference, see the Next GOOSE cycle notice, which outlines the key steps and deadlines for GOOSE 2026.