TL;DR

With Lido V3 launching soon, concrete plans for staking growth via stVaults and institutional offerings, and a market-based rebalancing of the protocol for greater sustainability in sight, Lido’s initial mission to build a secure, decentralized, and simple liquid staking protocol for Ethereum has largely succeeded. Lido DAO is now poised for its next major growth chapter.

This proposal sets out a strategic focus for a new approach to growth:

- Vertically Up the Stack - building end-user products to capture higher value, establish a direct relationship with the user base, and gain a stronger strategic position

- Horizontal Expansion - moving into new asset classes to add breadth, capture new demand, and diversify revenue streams

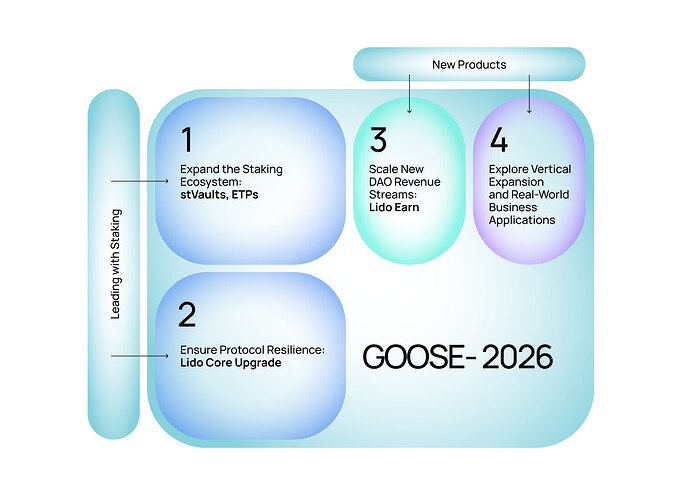

2026 Goals:

- Expand the Staking Ecosystem

Focus: Strengthen adoption of stETH and stVaults through active distribution, new integrations and partnerships including the expected launch of the staked ETH ETF in the US. Expand the stVaults line with a modular “constructor” for rapid launch of custom DeFi structured products

- Ensure Protocol Resilience: Lido Core Upgrade

Focus: Deliver Curated Module v2 and Staking Router v3, introducing ValMart, a validator-market mechanic that routes stake by performance, cost, and decentralization

- Scale New DAO Revenue Streams: Lido Earn

Focus: Expand to serve diverse user segments with tailored yield and risk profiles, scaling into a strong revenue line

- Explore Vertical Expansion and Real-World Business Applications

Focus: Explore real-business DeFi, connecting offchain economic activity to onchain liquidity, through a dual-track approach: running multiple fast, lean projects securing fast wins, balanced with the pursuit of a single large-scale, billion-dollar opportunity

In parallel, the GOOSE-2 goal of “LDO alignment” is expected to be advanced in H1 2026 with the deployment of the NEST system, subject to a DAO vote, which will align LDO token success more directly with the Lido protocol’s success through onchain buybacks financed from DAO revenue.

These are the first steps toward a proposed evolution from the staking leader into the primary DeFi gateway for real businesses, powering the new era of global finance.

DeFi’s center of gravity is shifting toward real-world business utility. As Ethereum becomes the settlement layer for tokenized assets and real-world finance, this is the environment where Lido’s next major growth opportunity lies.

Over the next three years, the proposed strategy is for the Lido DAO to take position at the center of this shift, bridging onchain liquidity with offchain economic activity, developing products for real-world businesses who seek onchain treasury management, financing, and investment, and giving them access to secure, scalable, and composable DeFi infrastructure.

1. Introduction

This submission is presented to the Lido DAO by the Lido Labs Foundation in collaboration with the Lido Ecosystem Foundation and the Lido Alliance BORG. Each of these independent entities has received Lido DAO grants to make contributions to the Lido protocol, working together under defined agreements outlining their roles and responsibilities. The submission proposes a set of strategic goals for 2026 cycle for the Lido DAO consideration within the GOOSE (The Guided Open Objective Setting Exercise) framework. Alongside this submission, a complementary EGG proposal will soon be published separately to outline execution paths for these goals, illustrating how the Lido Labs Foundation, the Lido Ecosystem Foundation, and the Lido Alliance BORG could help bring them to life once approved by the DAO.

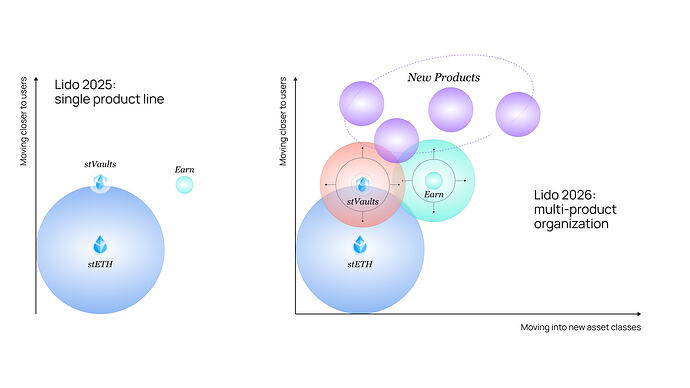

The current proposal puts forward a plan for the Lido DAO to evolve from shepherding a single-product protocol focused on liquid staking to an innovative organization with a product portfolio, deepening reach with current users, addressing new market segments, creating new revenue streams, and laying groundwork for future DeFi applications that serve real-world business.

Making staking as accessible and useful as possible is the idea that made Lido great, and it changed Ethereum forever. Lido has largely fulfilled its original mission: to build a secure, decentralized, and simple liquid staking protocol for Ethereum. The protocol has maintained a perfect record, having zero incidents with monetary impact on users since launch, Dual Governance as a unique safeguard that allows stakers to exit the protocol in case of disagreement with governance direction (or a possible attack), and a diverse operator set of 683 unique node operators with permissionless entry through the Community Staking Module (CSM).

Today, as the staking market matures and competition intensifies, primary growth avenues are supporting the flagship product, stETH, with adjacent offerings like stVaults and ETPs to increase the user base, and expanding beyond staking through new product lines, such as structured products, into the broader DeFi landscape. This is expected to lay the groundwork for Lido to lead the next wave of DeFi growth, powered by real-world business adoption.

2. Proposal

This section sets out a proposed set of strategic goals for Lido DAO for the 2026 cycle, together with a three-year vision. If the proposal is accepted, Lido DAO will adopt the following goals as its own strategic direction and enter its next growth chapter by expanding its staking product line and developing end-user products that capture higher value and strengthen its strategic position, broadening the offering, attracting new demand, and diversifying revenue.

2.1 Three-Year Vision

Staking becomes a mature, profitable product line

With Lido DAO’s core mission largely complete (see Lido on Ethereum Scorecard), the protocol now stands as a secure, decentralized, and scalable staking platform. The focus therefore shifts from foundational engineering to ecosystem growth: expanding the product portfolio to reach underserved user segments, deepening adoption, and delivering targeted, incremental improvements to the protocol. This new vector will strengthen the protocol’s sustainability and drive DAO revenue growth.

Vertical and horizontal expansion

- Vertical - build end-user products that capture higher value, deepen relationships with the existing user base, and strengthen strategic resilience

- Horizontal - expand into stablecoins and new asset classes, opening new sources of demand and diversifying revenue streams

The long-term bet: DeFi that serves real-world business

The broader DeFi market is maturing and gradually moving toward real-world use cases such as treasury management, borrowing, and investment.

The long-term goal envisioned in this proposal is to capture the next wave of DeFi adoption and position Lido as the primary gateway to DeFi for real-world capital through the development of an extended product stack.

2.2 One-Year Focus

To execute this vision, the following 2026 goals are proposed for the DAO’s consideration.

2.2.1 Leading with Staking

Over the last few years, the Lido protocol has cemented itself as the most robust and decentralized liquid staking solution at scale, allowing any user to participate in securing Ethereum, both from a capital as well as from a node operator perspective. After ETH, stETH is the most widely used non-stablecoin asset in Ethereum DeFi.

Growth in staking in 2026 will be headlined via the adoption of Lido V3 stVaults. As a new staking product, stVaults enable integrators, node operators, custodians, and large asset allocators to create tailored yield-bearing strategies for their customers with staking as the core engine, benefiting from the liquidity and utility of stETH.

Additionally, key integrations and regulatory tailwinds enable the further advancement of institutional-friendly packaging of stETH- and stVault-based staking, such as via Exchange Traded Products / Funds (ETPs / ETFs), allowing a broader swathe of users to benefit from the ability to earn rewards while securing the Ethereum network.

Lido Core will continue to be the flagship product, serving as the bulwark of the protocol and routing stake across hundreds of node operators around the globe. The planned improvements to Lido Core within the year will enhance the DAO’s economic sustainability while maintaining the high degree of decentralization at scale that the protocol is known for.

2.2.1.1 Expand the Staking Ecosystem

stVaults: Modular Staking Infrastructure

With Lido V3 Mainnet launch around the corner, Lido Staking transitions from a one-size-fits-most B2C model to a modular B2B2X ecosystem, where partners can build on top of its secure and liquid foundation.

The stVaults infrastructure enables customizable staking setups:

- Stakers (e.g. large capital allocators) can select their node operators and the staking setup

- Integrators such as layer 2s, node operators, wallets, custodians, and asset managers can design staking products with customized compliance requirements and their own fee structures, access to stETH liquidity, and build structured DeFi products on top

- ETP issuers can enable products with higher amounts of assets staked (when compared to products powered by native staking), and access stETH’s on-demand liquidity to potentially meet redemption requirements by regulators, while staking with their node operator(s) of preference

To accelerate adoption, building-block infrastructure that empowers partners to launch custom staking and DeFi products with minimal effort will be made available. The first step is the DeFi Wrapper, a low-code toolkit with ready-made components that simplify complex tasks like multi-user pooled staking on top of an stVault and automated looping against lending markets, making product creation faster, more secure, and composable.

Expectations for stVaults: 1M ETH staked through stVaults by end-2026, generating approximately 1k ETH ($2.8M at current ETH price) in annual recurring revenue.

Momentum is already visible:

- Linea plans to power their Native Yield mechanism, utilizing stVaults to stake most of the ETH bridged to Linea, turning the base token into a way to reward user activities on the network

- Leading Ethereum node operators such as Solstice, Chorus One, Everstake and P2P are working on their stVaults-powered products

- 38 early adopters have launched wstETH restaking vaults with Mellow

Lido Staking in ETPs

With increased regulatory clarity in key markets on the treatment of digital assets, as well as staking and liquid staking, the Exchange Traded Products landscape has seen a rapid evolution in 2025. As market participants gear up to enable staking in their digital asset ETPs, stETH stands out as a component product that could allow issuers and fund managers to meet the liquidity, redemption, and high stake rate requirements of discerning users. In October, VanEck (~$116.6B assets under management as at April 30, 2025) filed a registration statement for an ETF holding stETH, which will be available on US exchanges pending approval by the regulator.

The launch of stETH-based ETPs and ETFs, starting with the planned VanEck Lido Staked Ethereum ETF, marks a pivotal moment in connecting Ethereum’s native yield to traditional capital markets. These products provide investors access to staking rewards through familiar, regulated vehicles while supporting Ethereum network decentralization via Lido Core’s 683 node operators. By attracting a diverse range of participants, including asset managers, family offices, pension funds, and brokerage platforms, stETH ETPs and ETFs have the potential to unlock significant new capital inflows, accelerating the adoption of stETH and solidifying Lido’s role as the core staking middleware that powers institutional access to Ethereum staking.

2.2.1.2 Ensure Protocol Resilience: Lido Core Upgrade

The next major Lido Core upgrade, planned for 2026, brings together two components in active development: Curated Module v2 (CMv2) and Staking Router v3 (SRv3) with ValMart, a validator-market built directly into the router.

Together, they transform stake allocation in Lido Core from a simple round-robin system into a market-driven system, where operator fees, validator performance, and decentralization metrics determine how stake is dynamically routed and re-routed across the protocol.

Why it matters:

- Balance of market-driven efficiency & decentralization - DAO governance defines fee ceilings per operator type, and each operator sets its fee curve below that ceiling. Differentiated operator types (e.g. standard, client-team, or underrepresented-region) allow the DAO to shape the validator set it wants. ValMart then automatically routes stake to the most cost-efficient and reliable operators within decentralization guardrails

- Automated risk management - CMv2 introduces bonding for curated operators and links stake allocation and exit priority to validator performance, reducing protocol-level risk and enabling a shift towards more self-regulating, adaptive controls

- Higher operational efficiency - SRv3 adds granular control with partial deposits/withdrawals, stake reallocation between operators and modules, and balance-based accounting supporting 0x01 & 0x02 validator types. This enables smaller validators consolidation into validators with the maximum effective balance of 2048 ETH, reducing operational overhead and network footprint

The transition from the current Curated Module to CMv2 is expected to happen in stages. The first step is planned for December 2025, pending a DAO vote: classification of Curated Module node operators into distinct types with different potential fee ranges. This fee structure update will better align the Curated Module with the fee market expected to form after ValMart’s 2026 release, and is projected to raise the DAO’s share of staking rewards generated by the Curated Module by about 20%. The Curated Module currently accounts for roughly 92% of gross staking revenue for the DAO.

Expected revenue impact inclusive of changes proposed to take effect at the end of 2025: +2.6k ETH ($7.3M at current ETH price) in annual recurring DAO revenue, with possible future uplift once ValMart is implemented, from improved fee alignment and dynamic validator pricing.

This upgrade completes the Lido staking protocol’s technical arc, turning the staking router into an adaptive validator marketplace that balances performance, cost, and decentralization while strengthening the DAO’s financial base.

2.2.2 New Products

To secure long-term resilience and unlock new growth, this proposal envisions Lido expanding its product portfolio beyond staking.

The goal is to build a diverse set of revenue lines, opening access to new markets and user segments. These new products turn Lido from a single-engine staking protocol into an ecosystem where multiple product lines grow in symbiosis.

2.2.2.1 Scale New DAO Revenue Streams: Lido Earn

Launched in Sept 2025, Lido Earn opened a new product line for ETH depositors offering competitive yield vaults, including DeFi and Distributed Validator Technology (DVT) strategies. Early traction is strong: $180M in TVL and ~$2M in annualized fees within the first months.

Focus for 2026: expand Lido Earn into a scalable, multi-segment product suite that meets different yield appetites and risk profiles:

- DeFi Power Users - multi-strategy, auto-compounding vaults for ETH and stablecoins, maximizing blended yield

- Restakers - specialized restaking and looping vaults for users optimizing ETH yield

- Stablecoin Savers - lending and RWA-based vaults providing steady USD-denominated returns

- Passive Earners - pooled staking and low-volatility vaults for users seeking simple, “set-and-forget” ETH and stablecoin yield

- Treasury Managers - compliant RWA vaults with integrated KYC and reporting for stablecoins and ETH yield

ERC-4626 wrappers will enable seamless integration of Earn vaults into structured DeFi products built by external teams.

Expectations: reach $8M in annual recurring revenue by end-2026.

2.2.2.2 Explore Vertical Expansion and Real-World Business Applications

To expand the product portfolio, the Lido Labs Foundation in collaboration with the Lido Ecosystem Foundation and the Lido Alliance BORG will systematically explore, validate, and propose new ideas that bring Lido closer to users and real-world business.

This work follows a dual-track model - running many small bets in parallel while preparing for one large bet when the right opportunity emerges.

Track 1. Small Bets: Fast, Focused, and Scalable

Small bets are lean experiments designed to test new product ideas quickly, identify promising wedges, and secure fast wins. They operate on limited resources and short validation cycles. Each experiment must prove real market traction before requesting additional DAO funding to scale.

The goal is to build an internal venture culture with a framework where small autonomous teams can pitch ideas, secure “seed” allocations, launch MVPs, and measure outcomes transparently. Validated products graduate into larger lines of business. This process will turn Lido into a venture machine continuously discovering and scaling new growth engines while keeping risk contained.

Example: DeFi Accessibility Initiative

This initiative creates an integration layer reducing the cost and complexity for wallets, exchanges, custodians, and node operators to offer Lido products.

The product concept proposed for exploration is a B2B middleware solution: a set of dedicated smart contract vaults that allow integrators to manage deposits, rewards, and fees, combined with a configurable front-end widget/iframe and backend APIs for simple, custom integrations.

In the long-term, this product line has potential to evolve into an integration layer for real-world finance platforms like custodians and banks looking to offer a wider range of DeFi products, e.g., lending markets.

Expectations: $1M annual recurring revenue by end-2026, with significant scaling potential as adoption broadens.

Beyond this, multiple small bets will run in parallel, each probing a new wedge, market segment, or integration path, all built on the same playbook of fast testing and disciplined scaling.

Track 2. The Big Bet: Precision Before Scale

In parallel, Lido Labs will explore a potential Big Bet, a major expansion with billion-dollar revenue potential in real-business applications.

The principle is patience and precision: no early large commitment of resources until a clear strategic wedge and credible path to dominance are identified.

Once the right opportunity surfaces, where Lido has a unique edge and can lead a growing segment, the DAO can make the decision to back it decisively.

In summary:

- Small bets build momentum, validate ideas, and strengthen the internal product engine

- The big bet defines the next strategic leap, taken only when conviction is proven

Together, these tracks form an evolving product ecosystem around the Lido staking protocol - one designed for continual renewal and compounding growth.

3. Rationale

3.1 Overview of Lido Today

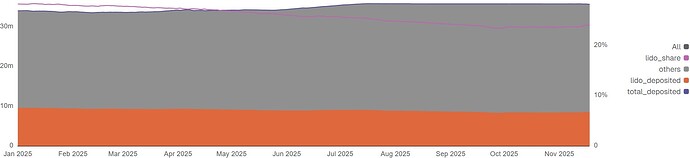

The Ethereum staking market has slowed. Growth stands at +5% year-to-date, down from +18% in 2024, with 35.7M ETH now staked. Liquid staking has plateaued, comprising 47% of total staked ETH, a figure that has remained unchanged for over 15 months, signaling a possible saturation. New inflows have shifted toward CEXs, institutional providers, and APR-maxi products.

Chart data source

Lido’s staking share declined from 28.3% to 24.1%, and its share within liquid staking fell from 60% to 50.8%, reflecting 1M ETH in net outflows year-to-date. That being said, Q4 has seen a reversal of the downward trend with positive net inflows in both October and November. The main drivers of the outflows were: delayed regulatory clarity around liquid staking (with earlier guidance favoring solo, delegated and custodial staking models), ETH absorption by ETFs and Digital Asset Treasury Companies, and APR compression that redirected yield-seeking users toward higher-risk alternatives.

Despite market headwinds, 2025 was a year of strong delivery on Lido’s technical and decentralization roadmap, with key unlocks coming at the end of this year that will strengthen the product basis and improve economics for the DAO in 2026:

- Lido V3 mainnet launch will introduce stVaults, a modular infrastructure layer, which broadens the solution space for builders and integrators looking to offer stETH to customers

- CSM v2 introduced the ability for the protocol to distinguish different types of node operators, and implemented a verified identity layer for community stakers. The upgrades to CSM have allowed it to reach a 4.25% share of the protocol’s total stake, with a sight to reach 10% in H1 2026, while remaining permissionless, enfranchising nearly 200 home stakers, and boosting DAO rewards from module-operated stake by 51% (from an effective DAO rewards rate of 4% to 6.04%)

- The Simple DVT Module (SDVT) grew to 322 distinct operators, all using distributed validator technology, strengthening the resilience of the protocol and offering users who preferred to direct their stake towards this module additional rewards in the form of DVT provider incentives, via the DVV vault now featured in Lido Earn

- Classification of Curated Module node operators into distinct types and a fee adjustment are planned for December, paving the way for the CMv2 upgrade in 2026, measures which are expected to increase the DAO’s share of Curated Module staking rewards by about 20%

- Dual Governance went live in July, empowering stETH holders with the right to exit in case of disagreement with LDO-driven protocol changes

- Triggerable withdrawals were implemented, improving protocol resilience and node operator accountability

- The protocol successfully navigated the Ethereum Pectra upgrade with no downtime or incidents

Today, Lido’s foundational mission is largely complete:

- Zero security incidents with monetary impact on users since launch

- Dual Governance safeguards stakers against capture and governance risk

- A diverse operator set with 683 unique active node operators, and open, permissionless entry via CSM

With the core attributes of the Lido on Ethereum Scorecard fulfilled, work remaining to balance economic sustainability of the protocol and decentralization incentives, such as CMv2 and SRv3, now represents incremental improvements upon the robust and resilient foundation.

This milestone allows the DAO to shift its focus from foundational engineering to product expansion and partner network development, building the next layer of growth upon the existing base.

The next chapter outlined in this proposal builds on what made Lido successful: security, trust, and pragmatic idealism. At the same time the historic constraints are turned into direction:

- Where distance from the user limited value capture, Lido moves up the stack

- Where long cycles slowed momentum, Lido embraces them as its strength, building securely and deliberately, placing long-term bets on products that create lasting value for real-world business

- Where revenue was concentrated, it opens new, diversified product lines

3.1.1 LDO Tokenomics & Alignment

Work on the GOOSE-2 “LDO alignment” goal continues into H1 2026. At its core is the NEST (Network Economic Support Tokenomics), a modular system designed to align the success of the LDO token with the success of the Lido Protocol. NEST enables swapping stETH from the DAO treasury to buy back LDO from the secondary market.

NEST development is underway, with the MVP delivery expected in December 2025.

The next steps include a community discussion on specific trigger conditions and parameters for LDO repurchases, such as cadence, thresholds, and allocation limits, followed by a DAO vote. After that, the automation module for NEST will be developed to implement the DAO’s decision.

3.2 How Will Ethereum’s Next Phase Reshape Staking and DeFi?

Ethereum is entering a new phase defined by improving regulatory clarity, growing tokenization of traditional assets, and major advances in scalability and user experience, positioning it for broad adoption.

Across the US and Europe, new frameworks like MiCA, the GENIUS Act, and the SEC’s guidance on staking have ended years of uncertainty, creating the environment for large-scale onchain finance.

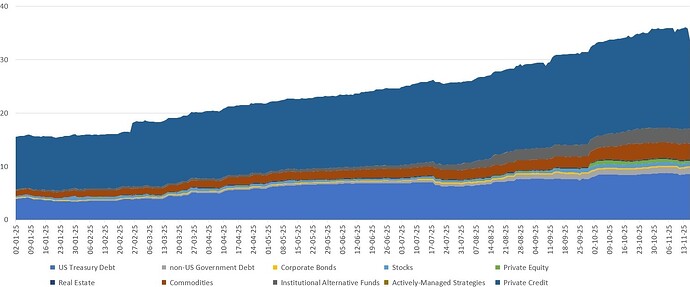

Meanwhile, the tokenization of RWA is accelerating: the total RWA market capitalization reached $35.6B (+130% year-to-date). Tokenized treasuries ($9.2B market capitalization) and private credit products ($18.6B market capitalization) represent the two largest segments, turning Ethereum into a regulated, yield-bearing settlement layer for traditional capital. Liquidity is fragmenting across L2s and appchains, but overall scale is expanding rapidly, while user experience is being abstracted to the point where DeFi finally feels like finance: simple, reliable, and composable.

Chart data source

These shifts are transforming DeFi from an experimental playground into a real financial layer. The next growth wave will be driven by practical use cases such as treasury management, credit, and investment, where reliability, product flexibility, and capital efficiency become prerequisites for adoption.

Therefore, having established staking as a robust foundation, this proposal sets out a path for Lido to ride the broader DeFi wave and build products that serve real-world economic demand, connect capital onchain and offchain, and position itself as the bridge between Ethereum and the real-world economy.

3.3 What’s Next for Lido

Under this proposal, Lido would position itself as the gateway for real-business DeFi, a long-term vision for the DAO to build toward.

It continues the same philosophy that made Lido the staking leader: pragmatic idealism combining technical rigor with real-world purpose. The vision goes beyond securing Ethereum to enabling it to serve the broader economy.

This next act:

- Builds on Lido’s strengths such as security-first engineering, a resilient brand, deep liquidity, a track record of pragmatic execution, and an unwavering focus on delivering the best user experience

- Turns historic constraints into direction, expanding value capture beyond infrastructure, connecting closer to users, and building diverse, durable revenue streams

- Focuses on real-world businesses seeking secure access to DeFi yields and liquidity, with the expectation that retail demand will follow through the same channels those businesses already trust

In essence, Lido’s next chapter would extend Ethereum’s reach from securing value to powering the flow of real-world capital.

4. Execution Approach

This section defines the guiding principles for teams executing on the goals approved by Lido DAO. If the proposal is accepted, executing contributors are expected to operate according to these principles when designing initiatives, allocating resources dedicated by the DAO, developing products, and communicating progress to the DAO.

Focus on measurable impact & cost discipline

Under this proposal, Lido’s execution model balances discipline and exploration.

The goal is to maintain excellence and commercial momentum in the core staking protocol, while selectively directing capacity towards scalable new products.

Every initiative will have clear success metrics: capital, time, and traction, with funding decisions driven by data and staged to ensure efficient use of resources and accountability for results.

Iterate through validation

New product lines, such as stVaults and Lido Earn, would begin as experiments and be validated through real user adoption, revenue signals, and feedback loops.

This evidence-driven process enables faster learning and continuous improvement, scaling what works and pruning what doesn’t.

Maintain optionality

Under this proposal, the product portfolio would include multiple small bets running in parallel on lean budgets. Each bet would be time-bound and success-gated: proven products earn additional funding, while others sunset without cost drag.

In parallel, exploration would continue for a Big Bet, a long-horizon opportunity pursued only when conviction and timing align.

This approach keeps Lido agile while preserving the upside of major breakthroughs.

Uphold resilience

Protocol security and reliability remain non-negotiable.

Every new venture will be bound by clear risk limits, ensuring that experimentation never compromises the safety, liquidity, or integrity of the Lido Protocol.

5. Closing Words

Together we successfully built and decentralized the largest liquid staking protocol, fulfilling the initial mission. Now, it is time to leverage that success for the next chapter of growth.

The landscape today presents a new, far larger opportunity: not just in securing Ethereum, but in extending its reach through new products, new assets, and new forms of value creation. In this proposal, staking is no longer the destination but the base layer from which Lido expands vertically and horizontally.

This next chapter is ambitious but it is built on the same principles of security, resilience, and pragmatic idealism that brought us this far. Let us build on our success to shape the next evolution of decentralized finance, that scales in depth, scope, and impact; ensuring Lido’s leadership for years to come.