Summary

We are proposing an automated buyback mechanism that will deploy LDO/wstETH liquidity in a Uniswap-v2 style LP position across the full range and keep ownership of the position in Aragon Agent.

If voted in, it could be done approximately in Q1 2026. However, the purpose of this thread is to invite opinions about the mechanism, the proposed parameters and discussions about alternative options to achieve the same goal.

NEST execution for LDO/wstETH liquidity

The simplest version of a buyback would simply acquire LDO through NEST. However, referencing the slippage tables from the earlier proposal, these executions could take place 14 times over the course of a year in 350k clips without exceeding 2% price impact excluding the cost of gas. The key tradeoff is slippage and gas. Larger clips and fewer executions will result in larger slippage but consume less gas.

The risk is that as the USD value increases, all else being equal, the pressure on the liquidity of the pool increases as well and potentially meets a limiting factor with available on-chain liquidity for LDO/(w)stETH. The bottleneck is clearly the supply of LDO, which even a Cowswap solver could eventually exhaust tapping CEX order books and onchain liquidity alone. Our proposal aims to solve this bottleneck by increasing the depth of the order book while simultaneously achieving the goal of removing LDO from circulation with excess surplus.

The framework proposed aims to limit buybacks to moments when ETH price is relatively high in USD terms and when the USD value of the annualized revenue exceeds a defined parameter.

For the sake of the example, the proposed initial parameters would be to enact surplus distributions while:

- ETH > 3000

- Revenue in USD > $40m

- Distribution: 50% of treasury inflows from staking over $40m

- Frequency: Limit to 2% total price impact based on prevailing market liquidity

- Cap: Maximum $10m on a rolling 12mo basis

If ETH price were to decline under 3000 or the USD revenue equivalent under $40m, the buybacks would not activate.

This model is anti-cyclical, in that the better ETH price does or the more USD revenues the DAO is able to generate through fees, the greater the absolute value is distributed and, conversely, in bear markets, the buybacks would naturally trend down until stopped to avoid over-distribution.

At time of writing, this would imply:

~$4m annualized distribution, executed over at least 12 trades or more throughout a 12mo period with up to 100 stETH deployed per execution (fewer if more frequent).

The LDO/wstETH LP alternative follows in the footsteps of the Maker Smart Burn Engine and deploys NEST orders for approximately half the value of LDO per clip but pair it in a Uniswap v2-style or Curve Cryptoswap LP position to progressively increase the liquidity depth for LDO onchain while still taking LDO out of circulation. Orders could thereafter increase in frequency over time, reducing the aggregate slippage loss per trade. An initial transaction directly from Aragon Treasury would mint the initial position and seed the pool with a 1-3bps fee accruing to the DAO as the LP holder.

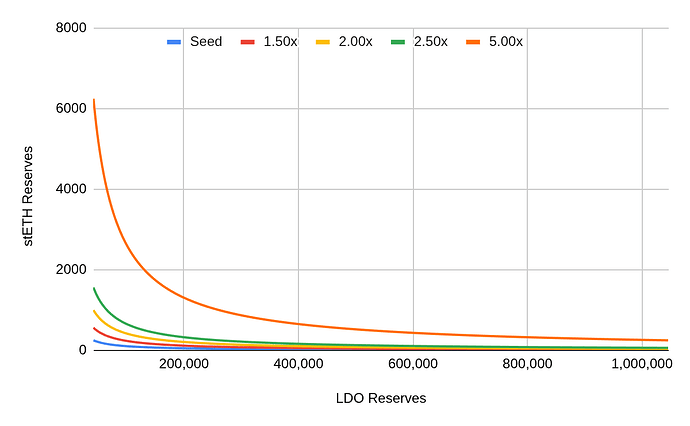

Chart assuming a $400k seed of a liquidity position (executed through a 50 stETH swap for 200k LDO and paired with another 50 stETH) along with the corresponding curve shifts with an increase in x of the pool size

The level of price impact improvement from relatively small increases in LP size through NEST would substantially improve the experience of using LDO onchain as well as effectively take LDO out of circulation.

The pitfalls are that development and execution are a bit more complex. Reliance on simple LP smart contracts, such as Uniswap v2, make the implementation a little bit easier at the expense of some efficiency for making the order book. The goal of this LP position is less to act as a profitable trader and more to increase utility to LDO while still achieving the goal of removing LDO from circulation through a buyback mechanism. It needs minimal maintenance in a set-and-forget approach that suits a DAO.

Technically speaking the process would look something like the following:

- NEST contract loaded through EasyTrack (either with a manual trigger from TMC or with a future automated execution)

- Some % is sold for LDO through Stonks v2

- Once the LDO is acquired, the balance of wstETH necessary to increase the LP position is wrapped with LDO into the pool

- The corresponding LP token is sent back to Aragon Agent smart contract

- If the amount of wstETH is insufficient, a new EasyTrack distribution can be made and the process restarted from #3

The ownership of the position would be the Aragon Agent smart contract, always in control by token holders.

Call to action

This scaffold proposal aims to seek community feedback prior to formal enactment through a Snapshot vote. In particular, we would like to hear feedback on the framework, the parameters proposed and if other alternatives might be more suitable or effective.