Request

V2 upgrade will unlock the withdrawals vault where ≈273k ETH reside. The Lido on the Ethereum will use these ETH to fulfil the withdrawal requests, and will restake them if there are no such requests. It’s estimated to require around 50 ETH to stake the whole amount currently residing in the vault. Normally it is funded with the Gas Funder multisig, but the budget depleted.

This proposal is:

- To request 50 stETH for deposit gas funding under V2 Aragon vote.

- The further funding of gas costs for deposits and Oracle operations is proposed to be implemented as Easy Track motions. Setting up the permissions & smart contracts necessary would follow, up to the onchain vote for switching those on.

Using historical data for 2023 and various safety margins, estimated gas expenses fall into 500 - 700 ETH per year, although actual gas expenses for the year ending 31 Dec 2023 most probably will be lower.

Limit for these Easy Track motions is proposed to be set at 1000 stETH per year, which shouldn’t be hit in a normal course of operation, but ensure depositing process continuity.

Background

Ether submitted by users is buffered on Lido stETH contract until it is deposited to the Consensus Layer.

Depositor bot (source code) performs deposit transactions and simultaneously monitors the current gas price on Ethereum to prevent excessive spending of ETH during sudden spikes in short-term gas prices.

Lido DAO has approved funding for this task (proposal#1, snapshot #1, proposal#2, snapshot #2). Deposit security committee also compensates mainnet Oracles gas expense and there is a proposal to compensate for gas Lido on Polygon.

History of funding

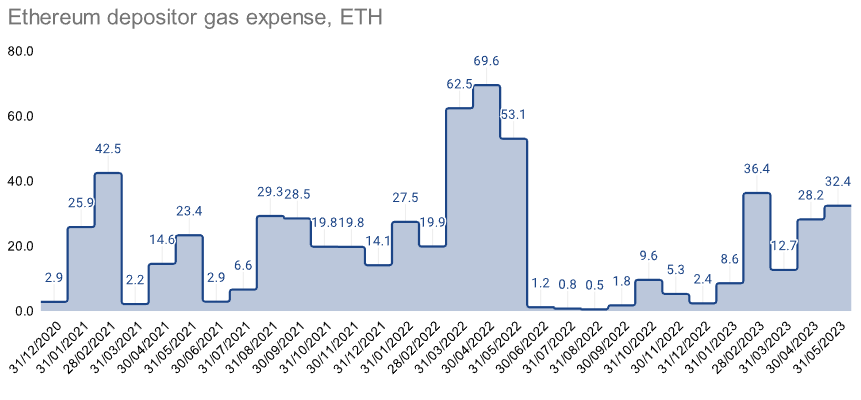

Previous rounds of gas expense compensations were made quarterly and soon after the last round that took place in May 2022 gas expenses dropped significantly, which in turn built up a long runway for this activity.

Recently gas expenses have risen due to an increased depositing activity (over 1M ETH were deposited into Lido protocol since the end of Feb 2023) followed by recent gas price rise in May 2023.

*please note that 31/05/2023 illustrates only first 8 days in May

These events contributed to rapid depletion of depositor bot multisig.

Although there is a reasonable doubt that gas expense per 1 ETH deposited into Lido on Ethereum will stay as high as it is in May 2023, it’s necessary to ensure deposits made in a timely manner to affect higher APRs (ETH in the intermediate buffer not staked) and funds are secured.

The amount of data that Oracles report will also significantly increase after withdrawals introduction, which will lead to an increase of gas spent to some degree.