Introduction

The following documentation is a proposal to invest a portion of the wETH currently inactive in Lido’s treasury fund into the soon-to-launch wETH pool managed by Maven 11 on the Maple Finance protocol. On a mission to redefine capital markets through digital assets, Maple Finance is a decentralized corporate credit platform that provides undercollateralized lending for institutional borrowers and fixed-income opportunities for lenders. KYC’d institutions can borrow funds from the lending pools managed by Pool Delegates, who are asset managers (such as Blackrock in TradFi) with credit expertise that assess the borrower’s credit worthiness and set up the terms of the loans such as interest rate and collateral ratio.

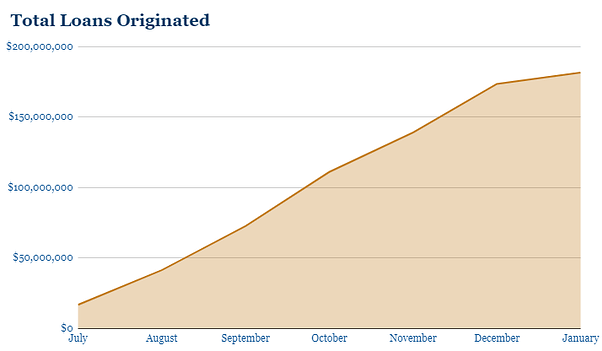

Maven 11 is a digital asset investment firm that combines deep roots in the DeFi ecosystem with professional expertise in finance. It was one of the earliest believers in Maple Finance which resulted in the investment in the project. Furthermore, we, as Maven 11, decided to take a proactive approach in our engagement with Maple and become the second pool delegate on the platform. Currently, we are managing one of the four pools on Maple Finance denominated in USDC. Considering the success of this pool, which was launched in July 2021 and has grown from $21 million TVL to over $180 million TVL in December 2021, we are looking to roll out a new liquidity pool denominated in wETH with target as launch date mid February 2022. Maven 11 would be the first Pool Delegate to launch a pool on Maple Finance with wETH as asset base. To bootstrap the new pool, we are offering the possibility to whitelisted lenders such as Lido to deposit $5 million ~in wETH of its treasury and to make Maple Finance part of the DAO’s treasury diversification strategy.

As we wanted to have all the competences and tools to successfully launch and manage the first pool, we opened a brand new lending division within our firm. For this purpose, we dedicated one quantitative analyst with a risk management background and hired an external advisor who has over 10 years of experience in high-risk loan origination and credit risk management who currently manages a EUR 2B credit book in his TradFi job but equally has been a DeFi participant for years and shares our passion and conviction to the space. This addition to the team has been instrumental in understanding and pricing risk for our Maple Finance activities. After our successful launch, we also added a junior with credit background and a director spearheading our institutional sales with over 15 years experience in capital markets, of which he spent 8 years in New York and was in managerial roles in institutional sales and trading at Kempen & Co, KBC Securities and NIBC.

The team behind the role of Pool Delegate of the USDC pool will manage the wETH pool as well. Therefore, Maven 11 is committed to further scale its lending division and we are continuously looking for new talents in the space that share our passion for DeFi and want to decentralize the future of lending together with us.

The numbers in the proposal for the USDC pool were last updated on the 18th of January 2022, so we cannot guarantee that they are up-to-date by the time of posting or reading. Pool specification on the wETH pool follows the same rules as for the USDC pool and will be discussed in the proposal section.

AMA session

Maven 11 and Maple Finance have successfully organized and held active AMA sessions with Keeper and Merit Circle communities for our proposals to deposit part of the stablecoins available in their treasuries in our USDC pool. Therefore, we are happy to schedule a Maple x M11 AMA with the Lido community in order to walk you through our origination and risk management practices and discuss the proposal more in depth. We invite you to read through the proposal as we are looking forward to any feedback, comments, suggestions, and concerns!

Rationale

Why invest?

Currently, assets in the Lido’s treasury are valued at approximately $508.7 million, of which ~$65.6 million is kept in ETH. Considering the information on Lido Finance from Token Terminal, the proposal is to deposit 20% of the average total revenues generated in 30 days.

The main purpose of utilizing a portion of the Ether in a wrapped version held by the Lido’s treasury to provide liquidity on Maple Finance is to generate an additional yield on now-idle assets. This will enhance the capital efficiency of the treasury, the value of which will ultimately find its way back to the members of the DAO.

As of January 2022, the yield generation on Maple Finance on the USDC pool managed by Maven 11 is successfully and regularly providing yield in USDC and MPL to its LPs, without incurring any of the possible risks in taking part of the lending process at the basis of its mechanisms.

We are aware that the risk appetite for the majority of DAOs is relatively low as the treasury assets are viewed as a buffer for potential adverse scenarios such as a bear market and as operational resources. Considering Lido’s treasury, we think that investing wETH instead of stablecoins on Maple Finance might be appealing for Lido’s community ( and other LPs ) that do not want to lose exposure on Ether while farming yield. We think that the lending opportunity in collaboration with Maven 11 Capital and Maple Finance as presented in this proposal is particularly suitable from a risk/reward perspective. This lending opportunity presents a solution that combines a relatively moderate risk profile while simultaneously offering a generous yield. Hence, it should be an optimal fit for your treasury diversification strategy.

Why Maple Finance?

As mentioned previously, Maple Finance’s platform is currently allowing KYC’d institutions to borrow USDC on an undercollateralized basis based on legally enforceable loans agreements. Maven 11 would be the first Pool Delegate to manage a pool completely denominated in wrapped ETH - exactly as for the USDC lending pools, these are semi-permissioned: liquidity provision is fully permissionless, i.e. any participant can freely deposit collateral, but borrowing is fully permissioned as ensured by a Pool Delegate (PD). These PDs are parties with credit and fund management expertise and act as asset managers for their pool. The PDs perform the activities required for the borrowing, i.e. identifying and reaching out to potential borrowers, assessing borrower’s credit worthiness, negotiating loan terms like interest rates and collateral ratios and monitoring of the exposure.

It is important to stress the strong incentive alignment between the PDs and the collective of depositors of the liquidity pool. PDs stake USDC/MPL Balancer Pool Token (BPT) as a protection mechanism which would take full hits until fully wiped out in case of loan defaults, ensuring that the PD has skin in the game as well as ensuring that LPs have a security buffer before their capital would be affected by a default in any form. The pool cover for the USDC pool managed by us amounts to ~ USDC 7.0 million which is largely provided by Maven 11. The same mechanism behind the current pool will be adopted for the wETH pool. Maven 11 commits to providing initial pool cover worth 1 mln USD in wETH:MPL LP on Balancer. This capital will be staked as pool cover during the lifetime of the wETH pool and can increase with time as the total pool size increases. There are concrete plans to increase the pool cover through deposits from 3rd parties that are also stakeholders in the Maple Finance ecosystem soon. Also, to address the issue of impermanent loss, Maple Finance plans to roll out a single-sided staking option where users will be able to stake their MPL tokens and other assets such as ETH and wBTC to provide the pool cover (late Q1 2022). Our target is to keep the pool cover for the wETH and USDC pools at atleast 10% of the pool size.

The features outlined above that are unique to Maple Finance allow them to position themselves as the new go-to undercollateralized liquidity provider for institutional borrowers. Because of this, the protocol has attracted many well-known and highly reputable borrowers for the USDC pool. The full list of previous borrowers, loan amounts and durations can be found here at the bottom of the page, but the list is composed of Alameda Research, Framework Labs, Amber Group, Folkvang, Nibbio, Orthogonal, Wintermute, and more institutions of similar reputation. For the wETH pool, the initial borrowers will consist of existing borrowers on Maple Finance that are fully KYC’ed and have built credit history on the platform such as Alameda Research, Amber Group and Wintermute. In total, there will be 4-8 market makers/trading firms that will borrow the initial liquidity from the pool to perform their usual market neutral trading strategies such as arbitrage or cash and carry. The use of funds by the borrowers will be in line with the strategies performed in the existing USDC pool. Finally, all of the initial loans will have a tenor of 90 or 180 days.

For the initial bootstrap of the pool, we are targeting between 30 to 50 mln USD worth of wETH to be deposited by whitelisted lenders, including other DAOs as part of their treasury diversification efforts. After the launch, the pool will be completely open to investors of the DeFi space, as Maple Finance and the Maven 11 pools want to grant access to such crypto-native, top-notch borrowers, which cannot be directly dealt with in an equally institutionalised and safeguarded process elsewhere.

To summarize, we think the lending opportunity presented here is appealing for the following reasons:

- The ability to generate an attractive yield on idle ETH in the treasury while diversifying treasury assets.

- Participation in a lending & borrowing platform where highly reputable borrowers are sourced by a PD with relevant credit and risk management expertise.

Statistics of Maven 11 USDC pool

The following is a summary to provide some context on the performance of the Maven 11 liquidity pool.

- The Maven 11 liquidity pool with USDC as base asset has grown from $21 TVL to over $180 million TVL from mid July when we launched the pool.

- We have funded 37 loans as of January 18th 2022, at a total value of over $181.6 million.

- 6 loans already matured and were repaid, 31 are active.

- The pool has faced 0 payment defaults.

The total composition of the USDC pool consists of market making/trading companies as well as yield funds. We are aiming at reaching a similar borrower type composition for the wETH pool and, exactly as in the USDC pool, we are dealing only with borrowers that are considered as market neutral (i.e. they do not have directional exposure to the market).

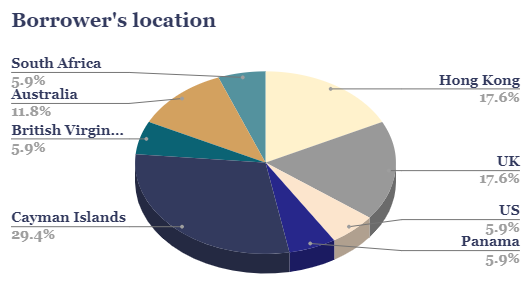

The distribution of the borrowers in terms of their size is very wide and ranges from 10M USD to as large as 10B+ USD.

The geographical distribution of the borrowers is also very spread. As we can observe on the pie chart, almost 30% of our borrowers are registered on the Cayman Islands while the rest is spread rather uniformly among other jurisdictions such as the US, Australia, Hong Kong or the UK.

The loan amount per borrower varies from $2 million to as much as $20 million. We are working hard to reduce the pool concentration with a target of maximum 10% of the pool size per borrower. We are close to achieving this goal, however it is worth noting that in the early phase of the project, larger counterparties require relatively larger loans compared to the smaller participants. Once the pool size grows substantially, the borrower base will follow, which will drastically reduce the exposure to a particular counterparty.

As we can observe on the following chart, the interest rates are hovering around the 10% mark, in fact, the average interest rate is currently 9.83% for our USDC pool. We expect the average interest rate for the wETH pool at around 5%-6%.

We started the pool with the loans set for 90 days to build a credit history with our borrowers and bootstrap the pool in a shielded manner. Currently, our loans in large majority have a tenor of 180 days. We are also exploring longer term (360 days) as well as super short term loans (30 days) to better fit into our borrowers’ needs.

For more statistics, please refer to the Dune Analytics dashboard or to the Maple Finance page.

Proposal

Amount and Duration of Investment

The proposal is for Lido to invest $5 million ~in wETH in the new liquidity pool where Maven 11 is a Pool Delegate. This amount of wETH would represent ~0.98% of the value of Lido treasury’s assets, or ~7.62% of the total ETH in Lido’s treasury. Providing this amount of wETH to the liquidity pool would maintain risk at an appropriate level with negligible risk for the overall financial health of the DAO.

Parameters

Amount of asset to be invested: $5 million ~in wETH

Minimum lock up period: 180 days (after 90 days you will be technically allowed to leave the pool but if the majority of the initial loans will be set for 180 days, you will miss significant amount of interest payments which will affect your APY)

Rewards

Below are listed the rewards for Lido and other whitelisted lenders:

- Lenders will receive yield in wETH and MPL tokens.

- Target range APY = 8-12% which includes 4-6% of wETH and remainder in MPL token dependent on the market conditions.

- Lenders commit their capital for 180 days with a 10-day cooldown period.

- Interest is distributed each time borrowers make their interest payments.

- MPL rewards are released on a block-by-block basis (no lock-up period).

Lenders receive 80% of the interest payments from the borrowers in wETH, while the remaining 20% is distributed in a 50:50 split to the Maple Finance treasury and the PD. On top of that, Maple Finance provides incentives to the lenders in their native governance token MPL which can be used for staking (i.e. providing capital of last resort in case of defaults) and for governance of the protocol and the treasury. In the future, it is also expected that the value capture of the MPL token will expand. The most prominent example of this would be to enable a pro-rata revenue sharing scheme between the Maple Finance protocol and token holders as well as the ability to boost a chosen pool with rewards (refreshed tokenomics are in works).

To summarize, depositing wETH in the Maven 11 liquidity pool on Maple Finance will generate two different types of yield: yield in wETH, and yield in the MPL governance token.

- wETH yield, as reported, has a target at 4-6% APY. This yield is released on an ongoing basis as the interest payments are paid.

- MPL reward token yield, boosting expected total APY to 8-12%. These MPL rewards are released on a block by block basis…

The APY itself is dependent on 3 factors:

- Interest rates - when the interest rates among the borrowers in the pool are increasing, the wETH part of yield is increasing as well (and vice versa).

- Amount of liquidity in the pool - when the pool increases in size, the rewards in MPL are decreasing proportionally as the number of MPL tokens needs to be distributed among a larger number of participants (and vice versa).

- MPL price - when the price of MPL is increasing, the rewards in MPL are higher in $ terms, effectively increasing the APY (and vice versa).

Risks

Smart contract risk

Participating in DeFi protocol comes with an inherent risk of smart contract vulnerabilities and bugs. In the case of participation in Maple Finance, a few mitigating factors can be noted. Firstly, the contracts used by Maple Finance have been thoroughly audited by Peckshield, Code Arena and Dedaub (please refer to the Maple Finance Github for more details). Secondly, the contracts are characterized by their relatively low complexity which leads to a low probability of exploits. Third, the utilization rate of funds in the liquidity pool will be very high as the one reported in the USDC pool, as we aim to keep as little cash as possible in the pool in order to consistently lend out the asset to borrowers and provide yield to our LPs (of course, keeping in mind that proper risk management practices are in place). Therefore, the smart contracts of Maple Finance become highly unattractive targets for hackers as the potential reward is very small.

Default risk

As Maple Finance facilitates undercollateralized lending, the protocol faces an inherent risk of borrowers defaulting. To mitigate this, Maven 11 together with other protocol participants provide the capital of last resort for our pools. This capital is liquidated first when the default of the borrower occurs, therefore it should be treated as a “junior tranche”. As a result, LP capital - the “senior tranche” - is affected on a pro-rata basis if the junior tranche does not cover the loan amount in full. On top of that, the borrowers are facing legal consequences on their defaults. They are obliged to sign a Master Loan Agreement (enforceable by NYC law) as well as to go through the full KYC process. Lastly, they are facing reputational risk, as a default on Maple Finance will likely translate into a complete drought of credit facilities for the borrower. It is relevant to note that the protocol has faced 0 defaults thus far.

MPL price risk

As mentioned previously, a portion of the yield generated on wETH deposits will come from MPL governance token rewards. This means that price appreciation of these tokens will lead to increased APYs, but naturally also means the same vice versa. The accumulation of these governance tokens will provide Lido with a stake in the Maple Finance project, but the value of these tokens is dependent on the growth and adoption of Maple Finance in the broadest sense.

Liquidity pool growth (decrease in APY)

As the liquidity pool grows in size, the liquidity incentivization through MPL governance tokens rewards will decrease proportionally as the total amount of MPL tokens emitted is distributed over a larger number of participants. We anticipate moderate, gradual growth in the pool.

Market conditions (decrease in interest rates on stablecoins)

If market conditions were to deteriorate, a low volatility period where our target borrowers i.e. market makers are less profitable, it would be sensible to assume that the demand for leverage would also decrease. This could lead to a decrease in interest rates, and thus a decrease in the APY for depositors.

Specification

The proposal outlined here is to be put through the Lido’s governance process in order for the community to be able to review the proposal and provide feedback where necessary. If the proposal is approved by the DAOs governance process, the implementation of the proposal should follow these steps:

- On Maple Finance, approve wETH to spend.

- Deposit $5 million ~in wETH to the Maven 11 liquidity pool and receive Maple Pool Tokens (MPT), to be eligible for receiving wETH rewards

- Approve MPT to spend.

- Stake MPT in Maple Finance, to be eligible for receiving MPL governance token rewards (do not confuse with staking for the pool cover, staking MPT is purely to receive MPL rewards and it is a technical requirement).

Final thoughts

We want to thank the Lido community for considering our proposal, and would love to engage in discussion about our offer. As mentioned previously, we are actively involved in the DeFi space and would really be happy to organize an AMA session with the community to go further in details over the proposal and address any questions or concerns!

If you have some initial questions about the proposal, you can check our FAQ Institutional Lenders. Here you will be able to find answers to common questions that institutional lenders may have before depositing in a pool managed by Maven 11. The covered arguments are:

- Borrower Selection

- Credit Risk Assessment

- Pool coverage

- Portfolio Management

- Expected returns

- Guide to deposit

- Reporting

- Regulations

Additional links: